09/09/2019

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.99 | 1.09 | 10'073.82 | 3'495.19 | 12'191.73 | 5'603.99 | 7'282.34 | 2'978.71 | 8'103.07 | 21'199.57 | 1'007.96 |

| Trend | |||||||||||

| %YTD | 0.60% | -3.40% | 19.51% | 16.45% | 15.46% | 18.46% | 8.24% | 18.82% | 22.12% | 5.92% | 4.37% |

Highlights:

1. Drop in Chinese exports

2. Job creation slows but remains solid in the US

Hopes pinned on central banks

Markets are trending upwards and situated not far from all-time highs, fuelled by the prospect of renewed trade talks between the US and China starting in early October. Meanwhile China’s central bank has announced a reduced rate for mandatory bank reserves as a way of stimulating cash injections into the real economy. News of a surprise 1% year-on-year dip in exports in August, coupled with a 16% contraction in exports specifically to the US, has stoked expectations of fresh stimulus, potentially including the first reduction in official interest rates in four years.

The labour market remains solid in the US, adding 130,000 jobs in August, although this was short of the 160,000 expected. The figures are hardly spectacular, thus giving the Fed a free hand to lower interest rates while thankfully not indicating that the world’s foremost economy is heading into a recession. The market-implied odds for a 25bp reduction in the benchmark rate, at the Fed’s next meeting on 18 September, stand at 92%.

In Europe, growth momentum halved to 0.2% in the second quarter relative to the first, pinned back by a contraction in the German economy and slower exports as the trade war started to bite. The outlook for Germany is hardly encouraging. Industrial production fell further in July, dipping by 0.6% month on month and 4.2% year on year and fuelling the debate on the need for some fiscal stimulus.

As we write the trend is still positive for risk assets thanks to extra support from central banks, low-lying interest rates and slack inflation.

But investors also need to stay wary. With such high hopes, the threat of upsets is equally high. One such hope is the end of the trade war as talks are due to resume between the US and China. Another is that a no-deal Brexit will in the end not happen. Then there is the expectation that central banks will make policy ultra-loose, starting on Thursday with the ECB – from which the market expects a rate cut as well as the resumption of quantitative easing.

Time for a new strategy in Europe

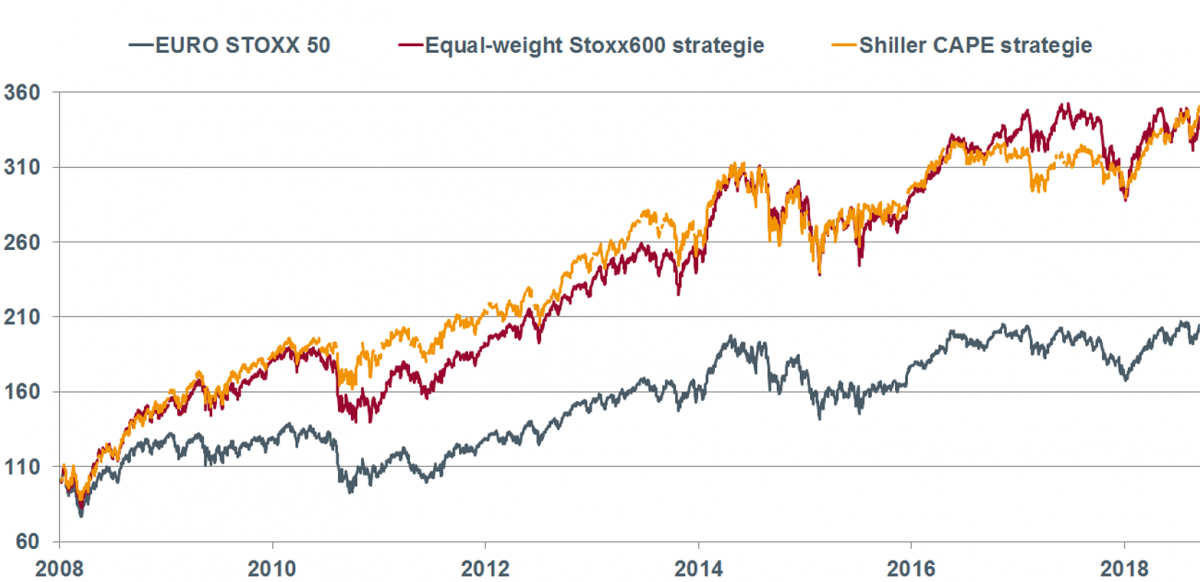

We have analysed the wide array of strategies available on the European equity market. Over the long term two have outperformed the benchmark EuroStoxx50:

- The equal-weight Stoxx600, which buys all the stocks making up the Stoxx600 index in equal proportions and then reweights the portfolio regularly.

- Shiller CAPE (cyclically adjusted price-to-earnings ratio), which picks the most affordable stocks in the market.

Shiller CAPE, named after 2013 Nobel laureate Robert Shiller, was designed for the US market but it can be applied to any marketplace that is broad enough in terms of number of issues and liquidity. The European market certainly fits the bill.

To see whether a sector is trading cheaply, Shiller suggests dividing the sector’s market capitalisation by the average earnings of its companies over ten years, adjusted for inflation. The strategy then invests in the sector stocks trading on low multiples by past standards. The portfolio is analysed at regular intervals.

As indicated by Chart 1, both strategies outperform the benchmark over the long term. The question is now, which one is better?

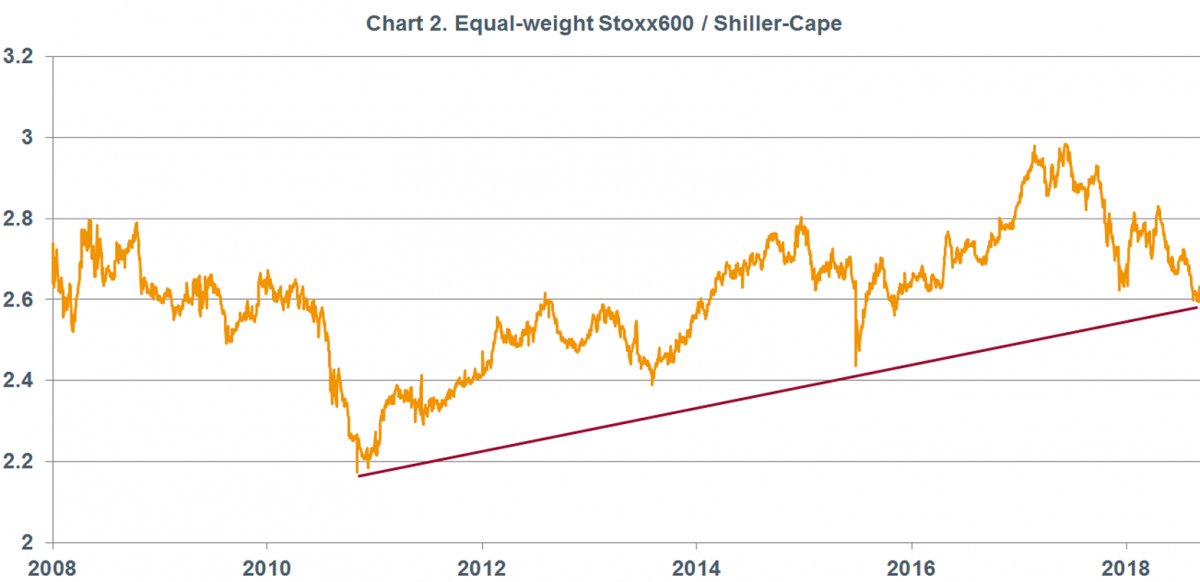

Chart 2 indicates the best time for each strategy, either the equal-weight or the Shiller strategy, by tracking the ratio between them. The lower the ratio, the more appropriate is the equal-weight strategy. The ratio’s current level suggests that the equal-weight strategy should be used at the moment.

Download the Flash boursier (pdf)

Flash boursier

Flash boursier