21/10/2019

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.99 | 1.10 | 9'965.49 | 3'579.41 | 12'633.60 | 5'636.25 | 7'150.57 | 2'986.20 | 8'089.54 | 22'492.68 | 1'024.02 |

| Trend | |||||||||||

| %YTD | 0.39% | -2.50% | 18.22% | 19.26% | 19.65% | 19.14% | 6.28% | 19.12% | 21.92% | 12.38% | 6.03% |

Highlights:

1. World trade slowing

2. Solid figures from major US banks

Brexit saga drags on

Brexit has continued to hog the headlines since the UK prime minister and the EU came up with a new withdrawal deal, which incidentally has sent both banking stocks and sterling higher. The vote in favour of this agreement was on Saturday lost by a small margin. Parliament also requested a delay so that the necessary legislation can be implemented in the meantime. All in all, the haze has not cleared, although it can be said that a second referendum is unlikely considering that the Labour opposition is divided on Brexit.

Considerable haze surrounds the terms of the partial trade agreement between China and the US. Beijing has reportedly pledged to buy more than USD 50bn in farm produce. In usual times, this represents two years’ worth of imports. The road is long but at least the two sides are talking again.

The IMF now projects that global trade volume will increase by only 1.1%. Germany is suffering. Japan’s exports have also been affected, dropping by 5.2% year on year in September. Manufacturing PMIs for the Eurozone are due on Thursday. A better overall figure is expected for October (46.2), but this remains a long stretch from the expansion mark (50). Latest US retail sales plunged by 0.3% month on month, and industrial production fell by 0.4% (although much of the damage can be ascribed to the strike at General Motors). Shockingly, China’s third-quarter GDP increased by only 6% year on year in the third quarter – its slowest gain since the 1990s. But look at the detail and we see that the consumer spending component actually increased (to 60.5% versus 55.2% in Q2), which is exactly what the government wants. Industrial production grew by 5.8% in September, and scope for monetary stimulus remains intact because inflation is confined to foodstuffs (specifically, pork).

Reporting season has begun for companies, and apart from some upsetting profit-warnings out of Europe (Renault and Danone), the results have come in above estimates, on average. The numbers reported by major US banks (JP Morgan and US Bank), coupled with higher long-term yields, are good news for the sector. Amid the slowing economic growth, the loose policies operated by central banks are set to continue underpinning valuations in equity markets. Inflation expectations have dipped in the US, suggesting that the Fed still has leeway to cut.

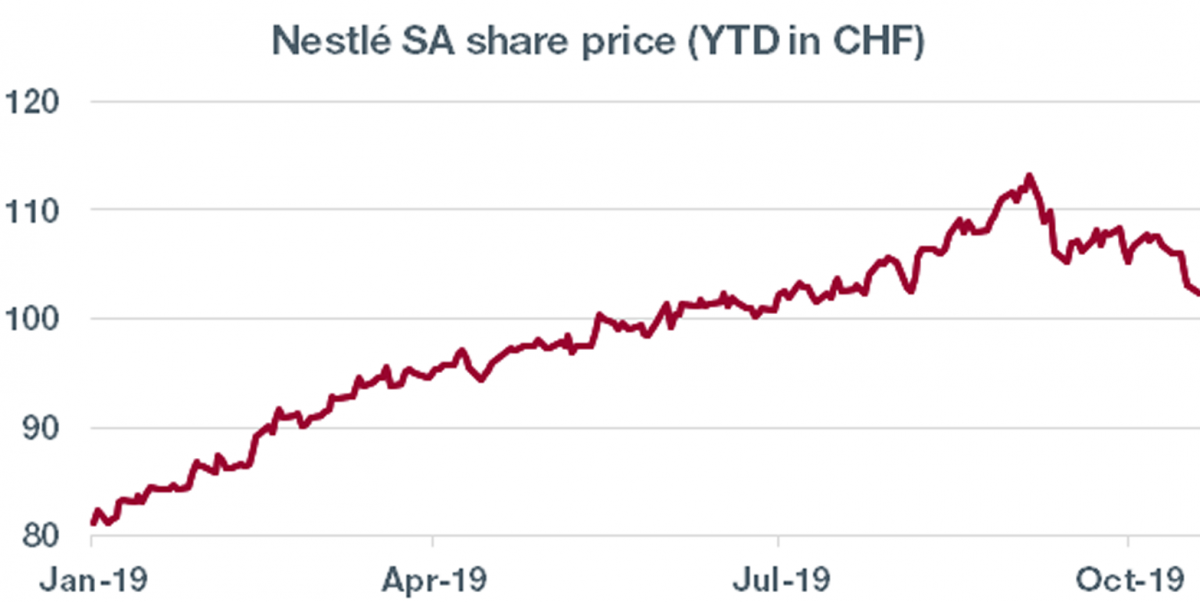

Nestlé SA (ISIN: CH0038863350, price: CHF 103.12)

Nestlé has reported sales broadly in line with expectations. Nine-month organic growth stood at 3.7%, driven ahead by the US and a growth spurt in emerging economies (except China).

All product categories saw growth. Especially strong were pet food and coffee. As a result, the forecast for operating profit of CHF 20 billion is still within reach despite lower coffee prices in Europe.

The only weak point is bottled water, sales of which dipped by 0.5% following a disappointing summer season in Europe. Restructuring will be needed to cater to consumers’ changing tastes. Nestlé Waters was set up in 1992 following the acquisition of Perrier. Today it houses around 50 brands. The purpose of restructuring will be to manage business more locally. It will also be made a strategic business unit with the aim of bringing growth into line with the industry (5-7% annually).

Nestlé reiterated guidance for 2019, namely organic growth of 3.5% and an operating margin of 17.5%.

The multinational also announced a share buyback as well as a special dividend programme. The total distribution is set at CHF 20 billion, financed by the sale of the skin-health unit (for CHF 10.2 billion) and the group’s strong cash flow.

Download the Flash boursier (pdf)

Flash boursier

Flash boursier