11/11/2019

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 1.00 | 1.10 | 10'309.23 | 3'699.65 | 13'228.56 | 5'889.70 | 7'359.38 | 3'093.08 | 8'475.31 | 23'391.87 | 1'064.85 |

| Trend | |||||||||||

| %YTD | 1.61% | -2.51% | 22.30% | 23.26% | 25.28% | 24.50% | 9.38% | 23.39% | 27.73% | 16.87% | 10.26% |

Highlights:

1. Investors relatively upbeat

2. Bond yields on the rise

Trump looking for a “good” deal with China

Despite conflicting information about the trade talks between China and the US, investors remain relatively upbeat about the outcome and have accordingly rotated out of sovereign bonds into equities. Moreover, cyclicals and banks have most recently outperformed defensive consumer stocks.

Bond yields have also trended up, buoyed by the prospect of better growth and resurgent inflation. In the US, for example, the return on 10-year Treasuries is back at 1.9%, its highest reading since early August. In Switzerland, the yield on the equivalent bond has improved from -1.2% to -0.45% in the same period. Some Fed brass have commented that no more rate cuts are needed this year, considering the solid state of the economy.

Regarding the trade talks, initial remarks suggested that both sides would cancel the increases in customs duties planned for December. However, there seems to be opposition from within the White House, and the meeting between Donald Trump and Xi Jinping to sign the ‘partial’ agreement could be postponed until December. Trump is adamant that everything is on track but he wants to sign a “good” deal. The US election campaign is already under way, and the sitting president can neither afford too much of a downturn in the economy or financial markets, nor renege on his ambitions to redefine China’s trade practices. However, the Chinese are in no hurry. Their economy is resilient, and their government is not facing an election in 2020.

The IMF has again lowered its growth forecast for the Eurozone as it sees trade barriers spreading from manufacturing to the services industry. It now forecasts a 1.2% increase in GDP this year and a growth rate of 1.4% for 2020 and 2021. In contrast, latest economic data are encouraging. In Germany, factory orders rose by 1.3%, fuelled by domestic demand. Exports also recovered, gaining by 1.5% relative to August. In China, exports dipped by 0.9% in October, marking a third consecutive monthly decline, but the figure was better than expected. Imports dropped by 6.4% year on year, which was better than the forecast 7.8% decrease and therefore calmed investor fears. In the US, consumer confidence is sitting at its highest level since July.

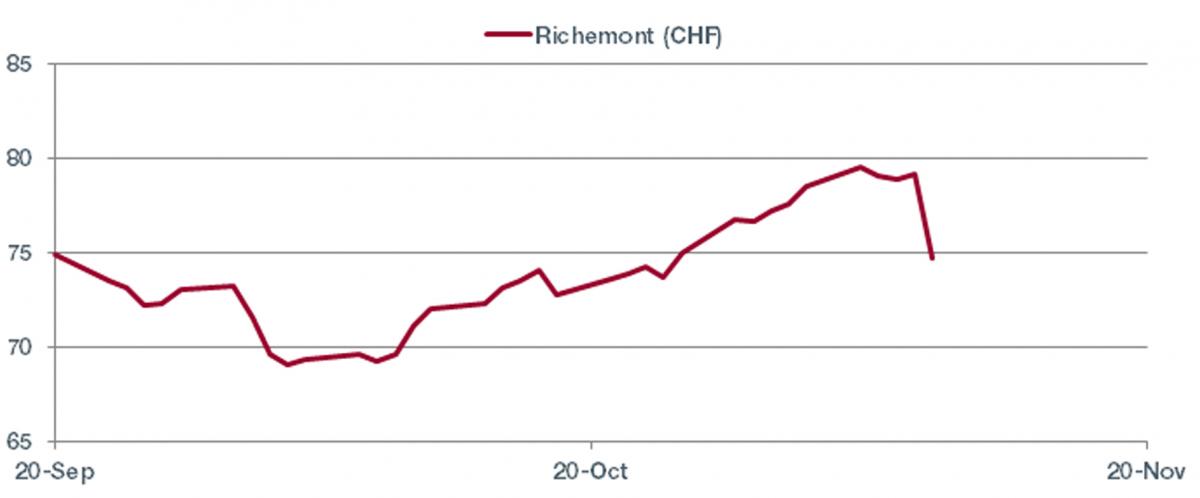

Cie Financière Richemont (ISIN: CH0210483332, price: CHF 74.68)

Richemont was sold off last Friday following the release of quarterly results. A closer look reveals figures that were not so bad. Sales rose quite solidly relative to the same quarter last year. So there is no underlying issue. The luxury goods sector is still growing, albeit not as quickly as before. In April to September, sales advanced by 6% at constant exchange rates. The problems is earnings, which fell by a reported 60% relative to the same period last year. This was due to a one-off gain last year skewing the basis for comparison.

Richemont’s business in China and Hong Kong shrank in double digits, hurt by exchange rates (Richemont reports in EUR) and store closures in Hong Kong in connection with the demonstrations. Nevertheless, sales in the Asia-Pacific region were up 5%, helped by Japan.

Management is still cautious about the future but no dark clouds are gathering. The slowdown in China and Hong Kong will probably be temporary. In our view, the correction has gone too far.

Share price in the past month

Download the Flash boursier (pdf)

Flash boursier

Flash boursier