24/02/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.98 | 1.06 | 11'110.78 | 3'800.38 | 13'579.33 | 6'029.72 | 7'403.92 | 3'337.75 | 9'576.59 | 23'386.74 | 1'084.22 |

| Trend | |||||||||||

| %YTD | 1.20% | -2.21% | 4.65% | 1.47% | 2.49% | 0.86% | -1.84% | 3.31% | 6.73% | -1.14% | -2.73% |

Highlights:

1. Price of gold and other precious metals rising

2. Downward revisions in earnings outlooks

Spread of coronavirus outside China stokes fears

The mood was most definitely ‘risk off’ as markets ended the week. Shares fell while long-term bond yields and the prices of gold and other precious metals headed northward. Ten-year Treasuries are yielding 1.4%. The yield on the equivalent Swiss government bond is minus 0.8%.

For now it’s hard to quantify the impact on global economic growth. Yet many companies, such as the likes of Apple, have already warned of a hit to sales and earnings in the first calendar quarter. We also expect a wave of downgrades in the earnings outlook. Cyclicals are looking in particularly bad shape. In China, sales of new motor vehicles as at mid-February were only 10% of what they had been in the same period last year.

Chinese officials seemed slightly more upbeat about stemming the virus. But the flow of news then took a sharp turn for the worse when it became clear that the coronavirus was spreading outside China. After South Korea, cases have been reported in Italy (in the regions of Lombardy and the Veneto), sending a wind of panic blowing through European equity markets. These two regions combined account for almost 30% of the country’s GDP. The main threats are fewer tourists and a downturn in manufacturing.

Stimulus measures are being enacted to counter the negative fallout that is expected to hit the global economy. Chinese authorities have relaxed the criteria for production plants to resume operations. Over USD 40 billion have been allotted to stopping the spread of the epidemic and propping up the economy. The South Korean government spoke of wanting to stabilise the forex market, domestic demand and exports. At the G20 meeting over the weekend, European leaders mentioned turning on the fiscal tap if the epidemic starts to dampen economic growth in the region.

As for macroeconomic statistics, the data releases had been quite encouraging. The moderate expansion trend is continuing on the back of a resilient service sector and more positive signs out of manufacturing. In contrast, the flash services PMI in the US for this month has contracted sharply to 49.4, compared with the consensus estimate of 53.4 – marking a six-year low. Quite surprisingly, fears over the coronavirus and its effects did little to dent the manufacturing PMI.

When the zero return on gold starts to look appealing

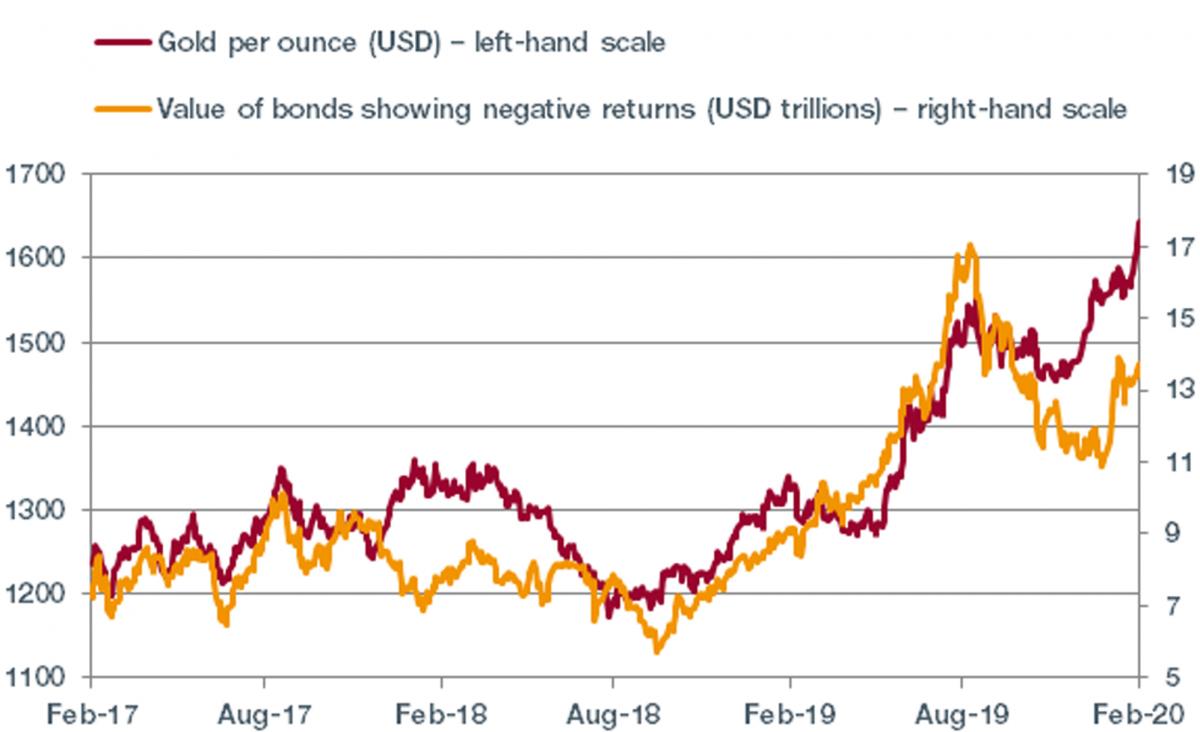

Holdings in ETFs investing in gold set a new record high in 2019 and there has been no let-up in demand so far this year, in which time the price of the gold ounce has risen above USD 1600.

One factor stoking demand is the lack of yields on high-grade bonds. Currently, the market value of bonds exhibiting a negative yield stands in excess of USD 13,500 billions (see chart below). In past times, investing in gold carried an opportunity cost, and that was giving up on interest. Gold doesn’t pay any. So the obvious choice for investors was government bonds paying a risk-free return.

These days, gold’s zero yield is perceived as an advantage relative to other assets. Negative yields have dented the appeal of government bonds relative to gold as a safe haven. Gold is now seen as a liquid alternative that does not suffer from counterparty risk.

We don’t expect interest rates to shift upwards any time soon, so the situation could persist for as long as inflation expectations are low-balling. And gold’s safety credentials could be further burnished by increasing fears of a coronavirus pandemic and any security flare-ups around the globe.

Flash boursier

Flash boursier