23/03/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.99 | 1.05 | 8'782.24 | 2'454.08 | 8'610.43 | 3'855.50 | 5'151.61 | 2'409.39 | 7'150.58 | 16'552.83 | 766.41 |

| Trend | |||||||||||

| %YTD | 2.01% | -2.90% | -17.28% | -34.47% | -35.01% | -35.51% | -31.70% | -25.42% | -20.31% | -30.03% | -31.24% |

Highlights:

1. Threat of depression looming

2. Central banks and governments step up their responses

Markets stressed

Financial markets are facing unprecedented disruption and who knows how long it is going to last. The crux of the matter is how long the economy will stay in shutdown mode. That, in turn, will depend on the success of the radical measures to halt the onward march of the virus as much of the world enters a period of quarantine. The cost of the pandemic, in terms of human lives and economic growth, is hard to quantify, and this is the factor that is stoking volatility in financial markets. For companies, there is talk of a 15-20% dent to earnings on average.

News over the weekend that House Democrats stood in the way of the USD 2 trillion aid bill proposed by the Senate (which in the end mustered only 47 of the 60 votes it needed to pass) has not helped. Democrats believed that the measures on the table equated to a bail-out of Wall Street and corporations, with little left in the pot for the honest worker. The climate of fear also worsened when a Fed official estimated that the unemployment rate could surge from 3% to 30% and US GDP could halve in the second quarter.

Last week showed the S&P 500 nosediving to wipe out its gains from 2019 and beyond. March is not yet over but so far marks the sharpest monthly fall in the index ever, on a par with the Wall Street Crash in November 1929. The sharp rise in the number of positively tested cases in the US (over 30,000) and the confinement measures introduced by several states to check the virus have stoked fears of an economic depression. European equities were reasonably resilient last week, shedding around 3%, possibly as investors reacted positively to the ECB plan (to buy EUR 750bn in bonds) and the massive fiscal aid packages that governments are putting in place.

Central banks and governments are stepping up their efforts to avoid liquidity crunches and provide state guarantees to companies and households. The former have slashed their base rates and instigated massive quantitative easing. The second have loaded up their budgets (with Switzerland offering CHF 32bn). But neither central banks nor governments seem to be coordinating their action globally. Sovereign bond markets are attempting to digest the dramatic implications of these spending programmes on public debt burdens. Spreads have started to widen in the Eurozone periphery (Italy -40bp). The private-sector bond market has been especially volatile as spreads have increased to levels not seen since the 2008 financial crisis.

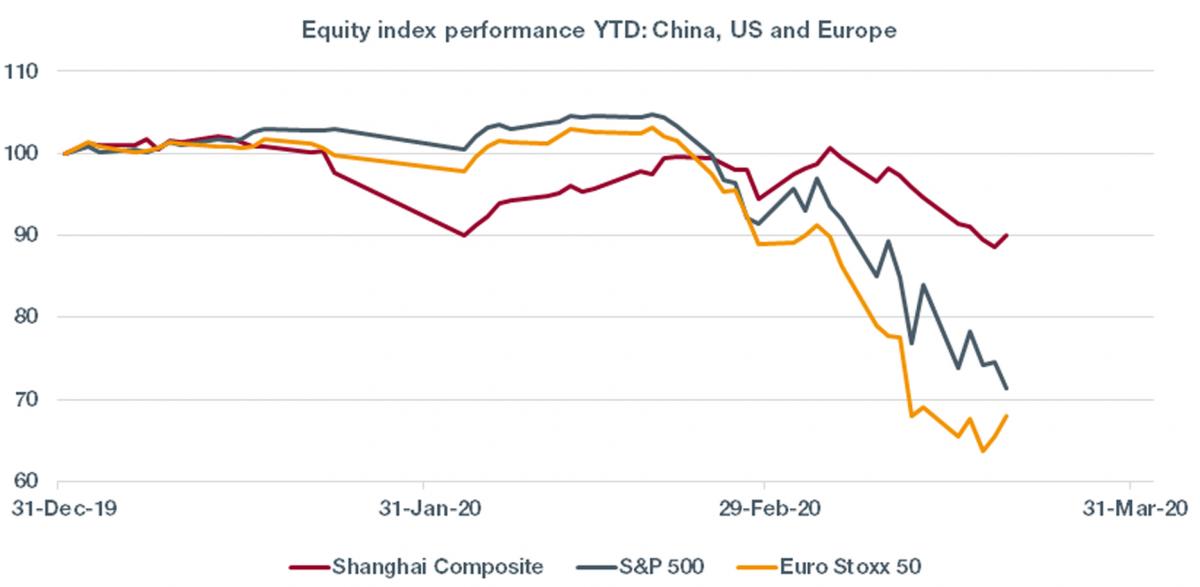

Chinese equities outperform developed markets amid the turmoil

Covid-19 first surfaced in the province of Wuhan, in central China. Two months later the WHO upgraded the threat from the virus to pandemic status, concurrent with lockdown measures from governments all around the globe. Financial markets have plunged amid anxious feelings of helplessness and doubt.

But the market in China is seeing the storm dissipate and head towards its neighbours. Take, for example, the performance on the mainland Chinese index, the Shanghai Composite, whose correction has been far less abrupt than its European and US counterparts.

Generally speaking, emerging markets tend to suffer more in times of woe because they are more vulnerable on the economic front. In this case, however, China’s confinement measures have halted the progression of the virus. Europe and the US are currently in the eye of the storm. Their respective stock markets will remain extremely volatile until the virus rate of progression starts slowing.

Flash boursier

Flash boursier