15/06/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.95 | 1.07 | 9'796.37 | 3'153.74 | 11'949.28 | 4'839.26 | 6'105.18 | 3'041.31 | 9'588.81 | 22'305.48 | 987.01 |

| Trend | |||||||||||

| %YTD | -1.57% | -1.25% | -7.73% | -15.79% | -9.81% | -19.05% | -19.06% | -5.86% | 6.87% | -5.71% | -11.45% |

Highlights:

1. Fed sounds sour note

2. German equities in pole position

Chilling prospect of renewed outbreaks

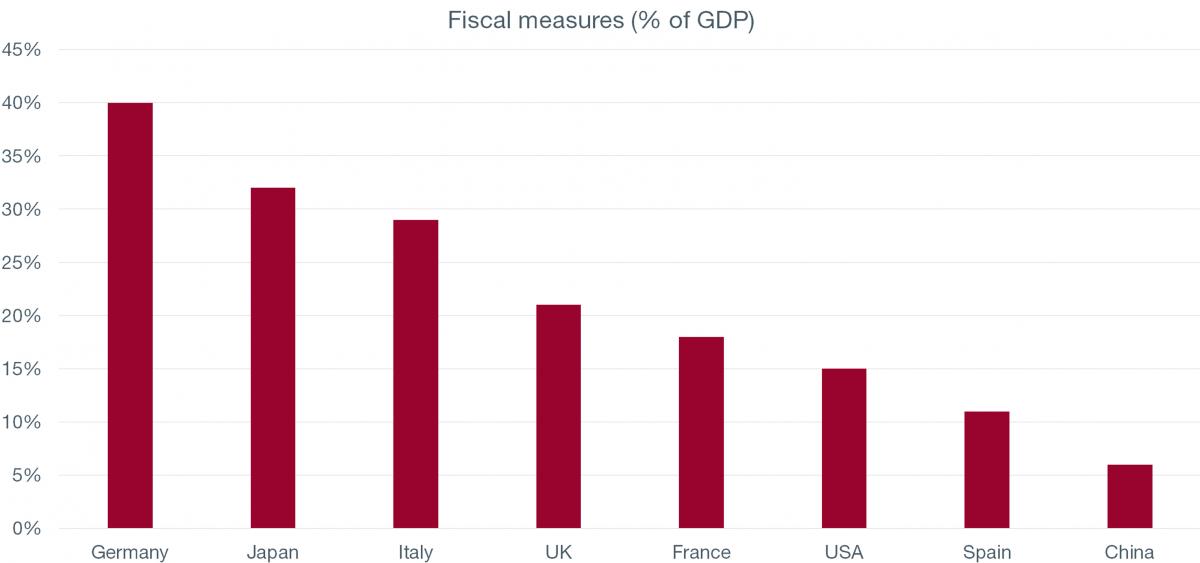

Investor optimism for a rapid economic recovery is fading, undermined by a string of downbeat statistics and Fed chair Powell’s rather gloomy stance on the economy, voiced in the wake of the FOMC meeting concluding last Wednesday. The World Bank is forecasting a 5.2% decline in the global economy this year and US elections are fast approaching, which is stoking risk aversion. Yet it should come as no surprise that investors are pocketing gains considering the linear recovery in equities and other risk assets since mid-March. In the meantime, European countries continue to ease lockdowns and travel restrictions, and it is unlikely that business will be shuttered up in the US. In this setting, German equities seem well placed to benefit as economies return to business is usual. Germany is moreover the country with the biggest fiscal boost in terms of GDP (40%).

Last week was bad, featuring a sharp decline in the main stockmarket indices, a plunge in banking stocks, a widening of credit spreads and a surge in volatility towards 40. Fears of a ‘second wave’ of worldwide Covid-19 contaminations – just as new outbreaks have been reported in the Chinese and Japanese capitals and within four major US states – continue to hold back the trend. Still, the 60 or so cases reported in China over the weekend, prompting localised containment in and around Beijing, need to be squared against the country’s population count of 1.5 billion. In the US, the states most at risk are California, Texas, Florida and Arizona, where new contaminations total more than 16,000. On the whole, however, the virus is seemingly not getting out of control.

FOMC members voted unanimously to leave US interest rates unchanged at close to zero, visibly until the end of 2021. The Fed is not even “thinking about thinking about” rate hikes, said Powell. Liquidity injections will continue at a rate of USD 150 billion per month. But according to the Fed, the it will take time for the economy to recover. Industrial production is expected to shrink by 6.5% in 2020 while unemployment is expected to clock in at 9.3% at the end of the year. All eyes will be on Powell’s testimony to Congress on Tuesday and Wednesday as investors seek clarification on how he sees the economic recovery progressing.

Economic data are still weak. Eurozone industrial production dropped by 17.1% in April. In China, it recovered by 4.4% in May, which was below expectations, after a gain of 3.9% in April. In contrast, Chinese retail sales fell by 2.8%.

European market: DAX in fine form

The market bounce in May considerably benefited the DAX, which comprises the 30 flagship stocks in the German market. So far this year, it has been the best-performing index alongside the SMI.

Optimism over an economic recovery following the lockdown is giving a boost to cyclical stocks, which had tumbled in March. But for Germany specifically, it is the unprecedented economic stimulus that is driving share prices higher.

Despite a reputation for cool-headed borrowing and balanced budgets, Germany is today the country injecting the largest dose of fiscal tonic in relation to GDP. Based on announcements thus far, the stimulus represents about 40% of German GDP. By comparison, Japan and Italy are situated at around 30% while the UK, France, the US, Spain and China all have quotas below 20% (see chart).

The frontrunners amid this renewed interest for German stocks include Deutsche Bank and carmakers Daimler and BMW.

Flash boursier

Flash boursier