29/06/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.95 | 1.06 | 10'041.91 | 3'204.17 | 12'089.39 | 4'909.64 | 6'159.30 | 3'009.05 | 9'757.22 | 22'512.08 | 998.90 |

| Trend | |||||||||||

| %YTD | -2.06% | -2.01% | -5.42% | -14.44% | -8.75% | -17.87% | -18.34% | -6.86% | 8.74% | -4.84% | -10.39% |

Highlights:

1. Volatility up again

2. Selling after results of US stress tests

Prospects for economic recovery versus rapidly spreading contagion

Volatility shot up on equities towards the end of last week, sending share prices down sharply. Investors had to revise their numbers in the face of the IMF’s doom-laden economic forecasts (released on 24 June), the soaring number of Covid-19 cases in southern US states and China, and the higher-than-expected rise in new jobless claims.

According to headlines over the weekend, Covid-19 has now infected more than 10 million people worldwide and killed about 500,000 of that number, dashing hopes of a swift economic recovery. Another explanation for the correction is that the steady rise in share prices since late March had become disconnected from fundamentals in the minds of investors, many of whom are still cautiously underweight in the stockmarket, even as alternatives are lacking. That is a reassuring point for the future, especially as dividend yields are generally beating bond yields at the moment.

According to the IMF, the current slump is unprecedented, and it sees global GDP plunging by a record-breaking 4.9% in 2020. Worse still, the recovery is expected to clock in at just 5.4% in 2021. France has been singled out as one of the worst-affected countries, with a contraction of 12.5% projected.

Banking stocks were sold off last week in response to the results of US stress tests. The Fed has moved to suspend share-purchasing programmes and freeze dividend increases for major banks until September. But there was also positive news from US regulators, who are due to loosen the terms of the Volcker Act. If these changes go through, banks will be able to invest more easily in venture capital, and collateral on derivatives transactions will also be reduced.

Treatment of the virus is improving, leading to a lower proportion of persons hospitalised and fatalities. Even so, the business recovery is making a stuttering start, with fears of further closures looming if the pandemic were ever to get out of control again. Still, it is unlikely that a large number of industries will be shut down again, given the resulting damage to the global economy. The upturn will be slow, granted. But continued fiscal splurges, together with monetary giveaways by central banks, will provide vital support to economies. In that respect, investors can find refuge in the noble actions of the ECB, which has calibrated its quantitative easing in proportion to the gravity of the situation, while at the same time offering perfectly adequate guarantees.

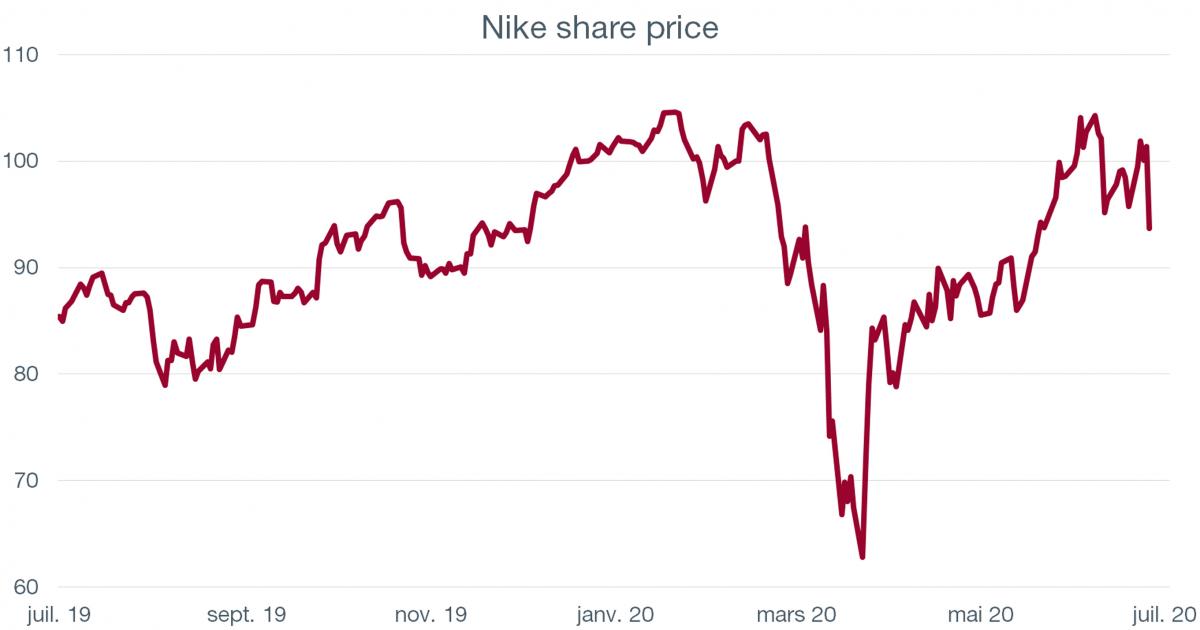

Nike (ISIN: US6541061031, price: USD 93.67)

Nike’s fiscal fourth quarter, ending 31 May, was pretty bad. Revenues plunged by 38% to USD 6.3 billion compared to $10.1 billion in the year-earlier period after 90% of stores were mothballed during an eight-week period as a result of the Covid-19 pandemic. Sales declined by 46% in Europe and the US, while in China, where all stores had been open for a while, the damage was limited to a 3% decline.

A profit of USD 1.2 billion in the same period last year turned into a net loss of USD 790 million this time round, working out as 52 cents per share – the first loss reported by Nike since 2009. Operating margin fell sharply to 37.3% due to higher costs stemming from swelling inventories and delivery cancellations by wholesalers, sales to which were down 50%.

Yet all this is a blip and should be more or less ignored by investors. Importantly online sales, which earn lofty margins, shot up by 75% over the quarter, rising to represent almost one-third of sales. Nike is also investing to increase the share of direct-to-consumer sales. Plus cost-cutting drives, including headcount reductions, are in progress.

So does that mean that Nike is a buy? At more than 30x forward earnings, the stock price is probably pricing in a flawless business performance. But the company has a dominant market position, aided by solid prospects for growth in sportswear and footwear demand, the strength of its Jordan franchise and strong product innovation.

Flash boursier

Flash boursier