31/08/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.90 | 1.08 | 10'164.49 | 3'315.54 | 13'033.20 | 5'002.94 | 5'935.98 | 3'508.01 | 11'695.63 | 22'882.65 | 1'121.60 |

| Trend | |||||||||||

| %YTD | -6.55% | -0.84% | -4.26% | -11.47% | -1.63% | -16.31% | -21.30% | 8.58% | 30.35% | -3.27% | 0.62% |

Highlights:

1. Lastingly low interest rates

2. European recovery plans in the pipeline

Same old story

The past few weeks have been very similar. The US market – powered by a weaker dollar, rock-bottom interest rates and a lack of viable investment alternatives – continues to surge ahead undaunted, setting a string of new records. No one is focusing on the bad news, whilst any sniff of good news is being used as a pretext for a continued bull market. Tech stocks are still leading the way. The Russell 2000, the flagship index of American midcaps, may be down 5% year to date but the Nasdaq 100 is up a staggering 38%. This powerful rally is being driven by just a handful of stocks. Nearly 50% of the appreciation by the S&P 500 (+9.9% year to date) can be pinned on the four heavyweights of the year: Apple, Microsoft, Amazon and Nvidia. Apple’s stratospheric ascent to the $2trn market-cap mark is alone responsible for 28% of the index’s progression!

The unconditional support of central banks, especially from the Fed, is still the powerhouse behind this market move. Fed chief Jerome Powell last week announced that the central bank would henceforth only aim to maintain an inflation target of 2% “on average”. This is tantamount to saying that interest rates will remain low for a long time to come.

In Europe, the confidence index has improved for the fourth month in a row. The market is awaiting the details of the economic recovery plans to be released in the weeks ahead. On Thursday, France is due to announce its €100bn splurge, with Italy and Spain unveiling details of their blueprints later. At this stage, the tourism remains one of the worst-affected sectors on account of the pandemic. A recent report by the World Tourism Organisation showed that nearly 120 million jobs worldwide are threatened and the economic damage could stretch to $1trn dollars. More and more countries are enacting tit-for-tat quarantines on holidaymakers, which is making matters worse, especially in those countries for which inbound tourism represents a significant chunk of their economy.

Glancing over at China, we can see an economy that is faring relatively well, with growth in the service and construction sectors accelerating in August. At the same time, the pace of growth in the manufacturing sector remains virtually unchanged month on month. This key component of the Chinese economy is now back at pre-crisis levels despite some wide disparities in business performance. Everything depends on the type of industry, of course. In any case, China now knows that its fate hinges much more on domestic spending than in the past.

ANT Group (IPO)

Chinese billionaire Jack Ma is about to conduct a record IPO for the second time in its history. Ant Group, the financial jewel in the crown of e-commerce giant Alibaba, plans to make its debut on the Hong Kong and Shanghai stock exchanges as it seeks to strengthen its dominance of online fintech services. Ant Group reported revenues of $10.5bn for the first half of 2020 together with $3.2bn in profit.

The company offers a platform for online financial services as well as in cloud computing, blockchain and risk control services. In addition, its Alipay application– the first digital payment application in China – also offers consumer and small business loans along with investing services and credit analysis using AI and robo-advisors. Alipay has more than 1 billion signed-up users, works with 80 million merchants, has partnerships with 2,000 financial institutions and processed a total of 118 trillion transactions in the first six months of the year, which was three times more than PayPal.

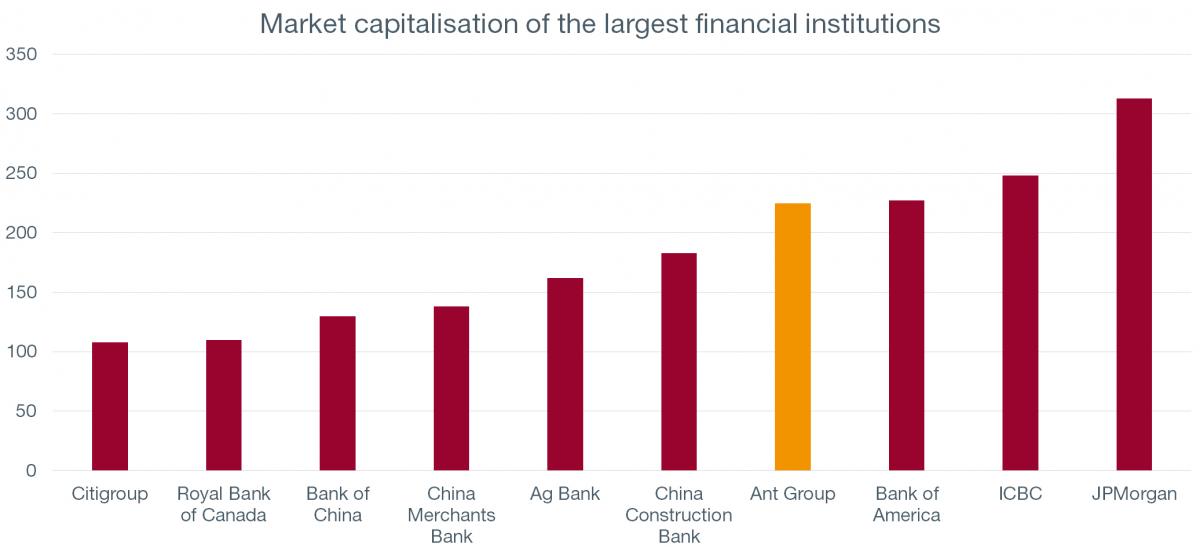

Based on targeted capital-raising of $30bn, Ant will be the largest IPO ever, exceeding Alibaba’s flotation ($25bn) and Aramco’s as well ($29bn). The group is valued between $200bn and $300bn, which is on a par with the market capitalisation of Bank of America and more than double that of Citigroup. Only JP Morgan would be larger by market value. Even so, an ever-increasing number of the largest financial institutions in the world are Chinese (see chart).

Alibaba is currently the main shareholder, holding a 33% stake. Ant group will not be listed in the US following the recent increase in tensions between Beijing and Washington. This paves the way for other Chinese technology companies to be listed outside the US and would mark a step forward in China’s efforts to establish its own capital market amid the power struggle between the two powers.

Flash boursier

Flash boursier