20/11/2023

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.89 | 0.97 | 10'737.37 | 4'340.77 | 15'919.16 | 7'233.91 | 7'504.25 | 4'514.02 | 14'125.48 | 33'585.20 | 976.52 |

| Trend | |||||||||||

| YTD | -4.21% | -2.36% | 0.07% | 14.42% | 14.33% | 11.74% | 0.70% | 17.57% | 34.96% | 28.71% | 2.11% |

(values from the Friday preceding publication)

Slowing inflation reassures markets

Equity markets continued making gains last week, their nerves calmed by the continued slowdown in inflation in the US and Europe.

As a result, bond yields continued to ease, with the 10-year Treasury dipping to 4.45% and its German equivalent to 2.60%.

Stateside, 12-month inflation fell by more than expected to 3.2% in October, down from 3.7% in September, reinforcing the prospect for the Fed to leave rates unchanged when it meets in December and to start cutting as early as the first half of 2024.

Core inflation, which excludes food and energy prices, was 4.0% on a 12-month basis – the lowest reading for almost two years. Part of the reason was the slipping oil price, hit by slowing demand.

The labour market is likewise showing signs of faltering momentum. Initial jobless claims for the week beginning 6 November came to 231,000. This was 13,000 higher than in the previous week.

Finally in the US, industrial production fell more than expected in October, decreasing by 0.6% after edging up by 0.1% in September. Manufacturing output was down 0.7% after rising by a revised 0.2% in September.

In Europe, 12-month inflation for October slowed in line with expectations, as evidenced by an HICP inflation easing to 2.9%, having increased by 4.3% in September. Month over month, inflation slowed to 0.1%. Excluding food and energy, inflation last month slowed to 5.0% year on year and 0.2% month on month.

In China, macroeconomic data last week pointed to an upswing in economic activity. The solid retail sales reported for October were greeted with a recovery in European luxury goods stocks, which had been under pressure since the summer. Industrial production rose by 4.6% after increasing by 4.5% in September. The rate of unemployment in urban areas was stable at 5.0%.

Against this backdrop, the S&P 500 ended the week ahead by 2.24% while the tech-focused Nasdaq gained 2.37%. The Stoxx 600 Europe put on 2.82%.

The latest information available provides further evidence that policy interest rates have peaked and central bankers may ponder making rate cuts as early as the first half of 2024, which has the potential of supporting market gains in the quarters ahead.

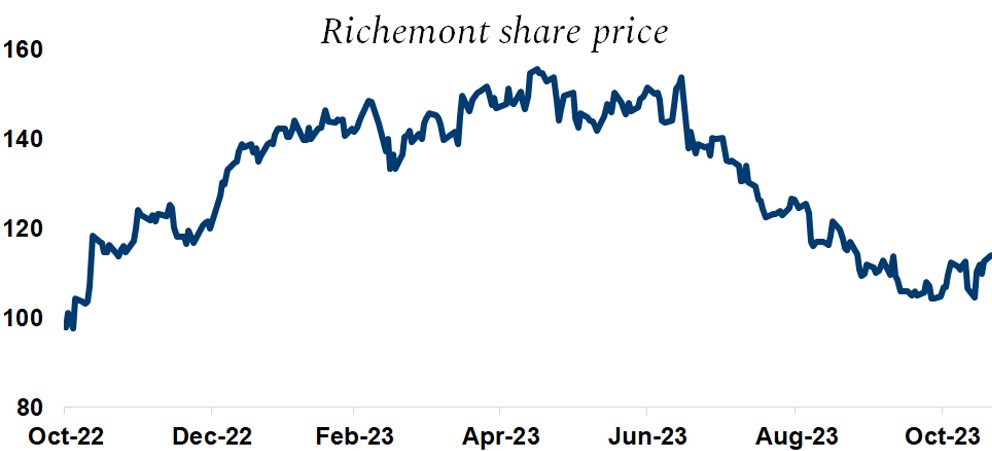

Richemont

Richemont disappointed investors when reporting second-quarter results on 10 November (split year), on account of exchange rate movements.

The share has lost close to 30% of its market value relative to the May high. Richemont got off to a strong start in its latest financial year, significantly beating estimates in its first quarter. But growth slowed sharply in the second as inflation, slackening economic growth rates and geopolitical pressure started to have an increased impact on consumer sentiment.

All in all, the latest figures were respectable but we can see exchange rates spoiling the picture.

Sales increased by 6% at actual exchange rates and by 13% at constant exchange rates, driven higher by Asia Pacific (+14%) and the Jewellery division (+10%). Operating profit edged down by 2% relative to the same period in 2022 to EUR 2.7 billion, resulting in an operating margin of 26%. Without the effects of exchange rates, margin was 28.5% on a 15% increase in operating profit.

Jewellery is still the fastest-growing segment in the luxury goods industry, with long-term growth estimated at 10-12% compared with 6-7% for the rest of the market. Jewellery maisons have continued winning market share from local manufacturers, China being a case in point. This division represents almost 90% of Richemont’s operating profit. As such, the group is well placed to harness this trend.

In short, the luxury goods sector is returning to normal in this second half of the calendar year, as reflected in more pedestrian growth rates. Looking ahead, however, the prospect of a soft landing for most economies, plus stronger growth than initially expected in China, are likely to underpin consumer spending momentum. The group’s management is convinced that underlying trends remain solid. We see the share, which at the time of writing is trading at around CHF 113, i.e. more than 30% below its five-year average, as a promising opportunity.

Flash boursier

Flash boursier