31/05/2021

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.90 | 1.10 | 11'426.15 | 4'070.56 | 15'519.98 | 6'484.11 | 7'022.61 | 4'204.11 | 13'748.74 | 29'149.41 | 1'360.78 |

| Trend | |||||||||||

| YTD | 1.70% | 1.45% | 6.75% | 14.58% | 13.13% | 16.80% | 8.70% | 11.93% | 6.68% | 6.21% | 5.38% |

(values from the Friday preceding publication)

“Sell in May” not sound advice this year

The month of May has not been an astounding month for US equities. The S&P 500 is so far up by only 0.9%. Even so, the investment adage “Sell in May and go away” has not rung true this year. European indices in fact have performed well, with the SMI leading the way with a 3.6% gain and the EuroStoxx 50 putting on 2.5%.

The latest weekly US unemployment stats, marking a low ebb since the pandemic began, put investors in a good mood – as did leaked news about the huge USD 6 trillion budget for 2022, which Joe Biden will soon be submitting. The President aims to make the US economy more competitive by spending more on infrastructure, education and healthcare, amongst other areas. If the plans are accepted, budget deficits in excess of USD 1.3 trillion per year can be expected over the next decade. The increase in debt would be cushioned by higher taxes and projected GDP growth. At this juncture, inflation is no longer spooking investors because bond yields have since fallen back, to 1.58% on the 10-year Treasury.

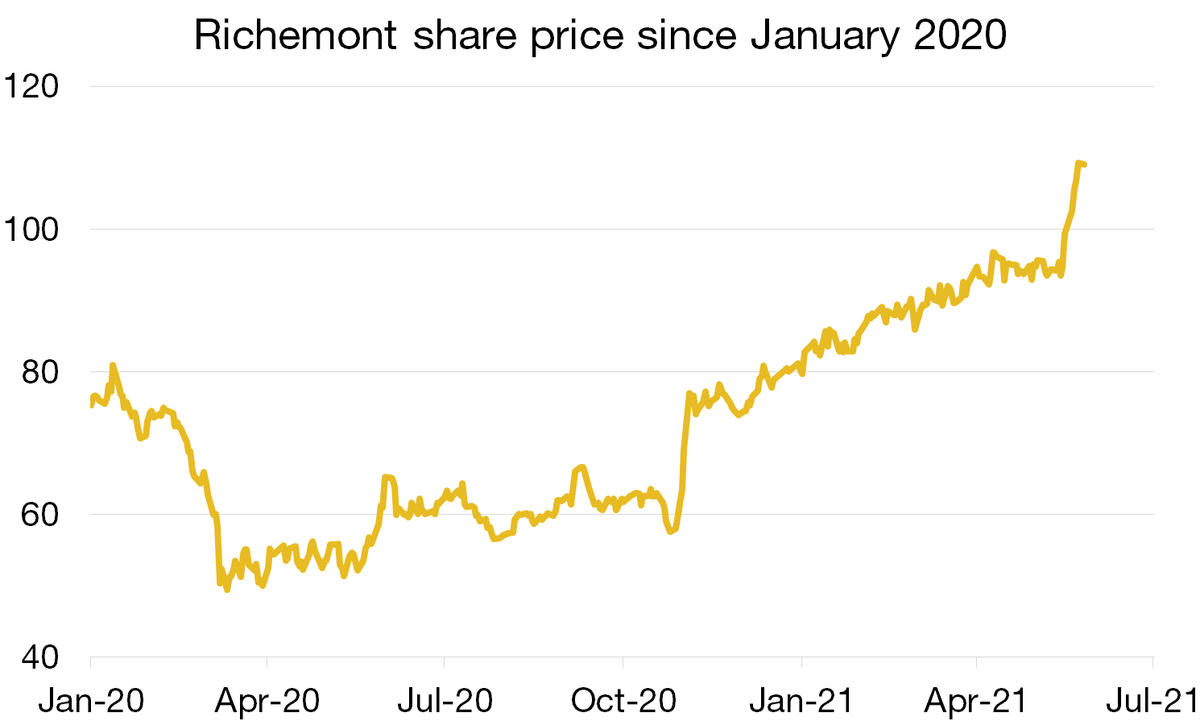

In Switzerland, the Kof economic indicator shot up to 143.2 in May, based on genuinely higher hopes for the manufacturing sector and stronger foreign demand. Signs of recovery are also emerging in the hotel industry. Clothing, chemicals/pharmaceuticals and plastics are experiencing solid business trends. Consumer spending remains slack but confident projections exist for employment and exports. The blue-chip SMI index advanced by 1.8% last week, spurred on by financials and watchmakers. Figures released last week showed a blistering five-fold increase in watch exports in April relative to the same month in 2020. Financial results reported by Richemont group also beat estimates. As a whole, the latest earnings season has been top notch for Europe’s luxury goods sector, which still has further to rise once the tourists flock back to Europe, added to its strong pricing power and the expansion of middle classes in emerging economies.

In May, European stock indices have outperformed their peers as significant foreign capital has flowed into ETFs and investment funds. In Europe, indices are weighted heavily towards cyclical and financial stocks, which has helped in a context of relaxed lockdown measures and accelerating vaccination drives. Banks are supported by the prospect of higher inflation, while the automotive and energy sectors are set to gain from the green energy transition. European equities currently have the largest foreign weighting in US asset allocations by region. Sectors sensitive to economic growth are valued affordably.

Compagnie Financière Richemont

The financial results reported by Compagnie Financière Richemont for its fiscal fourth quarter (to 31 March) beat consensus forecasts. The group has shown that it can weather a storm, with several divisions exhibiting growth and cash flow increasing.

Revenues clocked in at EUR 13.1 billion, down 8% (or by 5% at constant exchange rates) compared with the same quarter of 2020. This was more than investors had been expecting. In Europe, revenues plunged by 30% year on year, but the recovery in China (45% of total revenues) has been particularly strong since January 2021. Net profit jumped by 38% to EUR 1.29 billion and operating margin improved to 11.2%, up from 10.7% in the prior-year period.

Jewellery revenues (Cartier, Van Cliff and Arpels, Buccellati) were strong, driven by Chinese demand. As the market leader, Richemont is nicely placed to continue harnessing this positive trend. Digital transformation has accelerated, with online channels representing 21% of revenues based on the latest figures. Creativity enables Richemont’s brands to push through price increases. Women’s disposable incomes are rising worldwide, and prospects are rosy among the younger generations, especially in China, where people are especially drawn to prestige pieces. After months of lockdowns, consumers are ready and willing to spend, and the recovery in European tourism will boost in-store sales.

Flash boursier

Flash boursier