02/08/2021

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.91 | 1.07 | 12'116.82 | 4'089.30 | 15'544.39 | 6'612.76 | 7'032.30 | 4'395.26 | 14'672.68 | 27'283.59 | 1'277.80 |

| Trend | |||||||||||

| YTD | 2.34% | -0.64% | 13.20% | 15.11% | 13.31% | 19.12% | 8.85% | 17.02% | 13.85% | -0.59% | -1.04% |

(values from the Friday preceding publication)

China rings end of recess in online education business

Last week was highlighted by China’s intervention in the online private tutoring segment. This came after a series of measures aimed at toughening regulations that in turn affected the technology, real estate and delivery service sectors. Investors panicked following these harsh clampdowns by the regime, causing stockmarket benchmarks to reel nearly 10% on the week both in mainland China and in Hong Kong. Punters’ fears obviously stemmed from concern over who might be next. Year to date Chinese equities are down 10% and have fallen 30% from their all-time high reached in mid-February.

The authorities have been monitoring the lucrative online tutoring segment and its excesses for several months. Players were exploiting parents’ anxiety over not being able to provide their children with the best possible chances of getting a good education (through private tutoring and private supplementary courses) in preparation for their entry into China’s ultra-competitive labour market. Advertising campaigns by online education companies were becoming agressive and made parents feel guilty, goading them to spend increasingly larger sums to ensure their children’s success at school. These players were pocketing unseemly profits and creating inequality in the school system that was frowned upon. Worst of all, they were thwarting the government’s efforts to consolidate China’s demographics. After decades of the one-child policy, China now faces the need for more workers to compensate for population ageing. The authorities are therefore striving to encourage parents to have more than one child, since a low birth rate jeopardises their goal of economic growth. Parents who have to fork out too much money for their child’s education are deterred from wanting more than one. Already in 2018 the private tutoring segment generated revenues of almost USD 260 billion. The measures announced by the government last week reflect the stakes involved: companies in the sector may no longer make a profit, raise capital or make public share offerings. All this spells the end of their business model. Obviously the economy has no scope for development when it collides with the government’s long-term objectives … That, said, the panic appears to be over.

US inflation was clocked at 6.4% year on year at the end of the second quarter, higher than expected. Both the Fed and the IMF changed their tone slightly and now agree on the fact that inflation could be a bit stronger and longer-lasting than they forecast previously. On the face of it, the bond market is not worried. The yield on 10-year Treasurys slipped below 1.25%, down 0.50% since end-March.

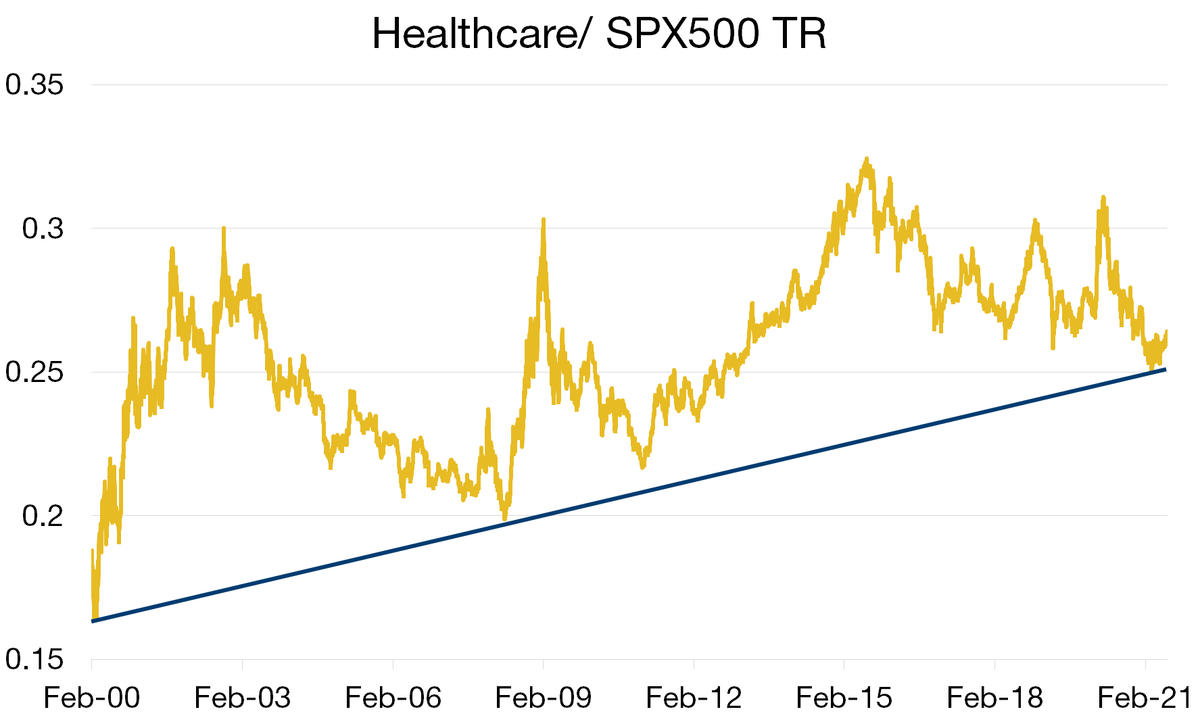

Healthcare stocks are attractively valued

Whereas stockmarket benchmarks stand near their all-time highs, the healthcare sector is currently trading at an enticing discount. Many pharmaceutical companies are considered blue chips thanks to their extremely healthy balance sheets. Yet their valuations are attractive compared with their markets’ benchmarks.

In the US, stocks like Bristol-Myers, Pfizer and Merck are trading 9 to 14 times earnings versus an average of 22x for the market as a whole. Likewise in Europe, Sanofi, GlaxoSmithKline and Novartis are trading around 14 times earnings compared with over 20x for their benchmarks. These last three stocks moreover offer dividend yields of over 3%.

The chart opposite shows the relative performance of the US healthcare sector vs. the SP500 index. The industry is attractively valued. The ratio currently stands near its support and appears to be poised for a recovery. This is a particularly good sign since pharma shares tend to outperform the broad market long term, as shown by the ratio’s long-term uptrend. From a technical standpoint, we therefore expect the sector to outperform and it will probably do so regardless of the market environment.

In Switzerland, Novartis is our favourite pick at present compared with Roche. The price ratio of these two Swiss pharma giants clearly argues in favour of Novartis at current levels.

Flash boursier

Flash boursier