18/10/2021

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.07 | 11'961.34 | 4'182.91 | 15'587.36 | 6'727.52 | 7'234.03 | 4'471.37 | 14'897.34 | 29'068.63 | 1'283.67 |

| Trend | |||||||||||

| YTD | 4.26% | -0.97% | 11.75% | 17.74% | 13.62% | 21.19% | 11.97% | 19.04% | 15.59% | 5.92% | -0.59% |

(values from the Friday preceding publication)

Equity indices gain despite pressure on yields

Fears about rising sovereign yields and runaway oil prices were soothed last week by solid US retail sales for September, up 0.7% whereas a downturn was expected, and the quarterly earnings reports from banks and healthcare groups, which were by and large firmly above estimates. Despite the pressure on the US 10-year yield, which edged up further to 1.6%, this news powered an upturn in leading equity indices over the week. Strength in corporate earnings is seen as crucial because the higher long-term yields have stoked concerns about the lofty price/earnings ratios exhibited by equities. Despite red-hot inflation and the prospect of the Fed tapering, the S&P 500 has risen 3% since the beginning of October and now sits a narrow 1.5% below its all-time high, while MSCI’s global equity index has recovered 2.3%.

Rising fuel prices combined with the soaring cost of transporting goods, including the surplus demand for ocean freight that in turn has driven up container prices, has shifted the focus to supply chains. Making matters worse, more and more headlines feature the word ‘stagflation’. The global economy is slowing down relative to preceding quarters. That is a given. But this is all still a far cry from the stagflation of the 1970s, when GDP growth tanked at the same time as consumer price indices were shooting upwards. Back then, unemployment was sky high and inflation in some places exceeded 10%.

Chinese GDP disappointed in the third quarter, rising by only 4.9% on an annualised basis – its slowest score this year. It also marks a precipitous decline relative to the 7.9% achieved in the second quarter. In short, the economic recovery is less robust than expected. This slowdown is due in particular to government controls to limit energy use and reduce the financial risks associated with highly leveraged property developments. Production output has also slowed down due to shortages of chips and other components. Notably, steel production tumbled by over 20%, while retail sales rose by 4.4%. The power shortages may persist for some time, but disruptions to supply chains are likely to ease.

The property market is beginning to feel the effects of Beijing’s crackdown, as demand ebbs and fewer new projects are being undertaken. The number of new builds contracted by 4.5% between January and September. In contrast, property investment increased by 8.8% over the same period.

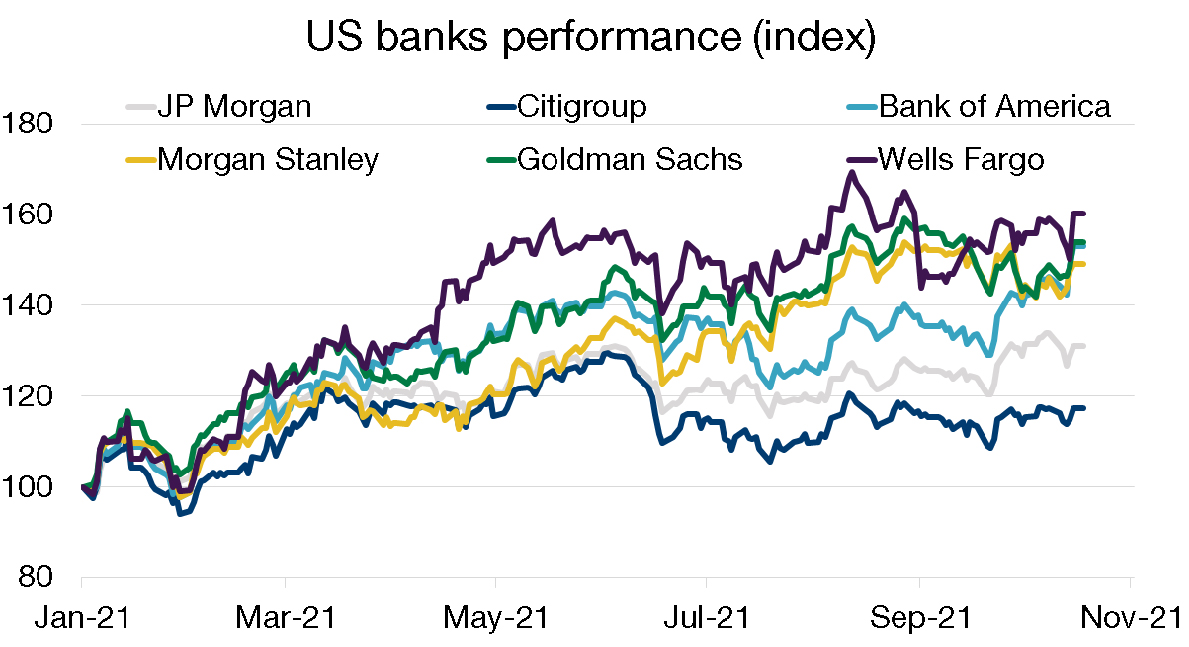

US banks report their results

The financial results from major US banks reported last week can be considered generally adequate. Profits surged and beat forecasts. Strong balance sheets and diversified business mixes helped these majors weather the effects of the pandemic respectably.

Helped along by the improved economic picture, profits were further boosted by a reduction in the reserves built up since the beginning of the year. The surge in mergers and acquisitions, following the return of the more optimistic outlook, served them well.

In particular, Goldman Sachs’ figures were streets ahead of estimates. As with its competitors, it experienced a significant increase in investment advisory revenues. Morgan Stanley’s investment banking business had its best quarter ever. Bank of America, Citigroup and Wells Fargo on their own scaled back loan-loss provisions by about USD 4 billion. Households and businesses have accumulated a lot of cash. For the time being US banks are not seeing any substantial growth in loan demand. As a result, for those more exposed to rates such as Bank of America, Wells Fargo, JP Morgan and Citigroup, net interest margin (difference between cost of deposits and interest paid on loans) has simply stabilised.

While waiting for lending to pick up, banks continue to rely on solid trading and M&A activity. However, it will be hard to keep these business lines ticking along at such a fast pace.

Flash boursier

Flash boursier