15/11/2021

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.05 | 12'516.05 | 4'370.33 | 16'094.07 | 7'091.40 | 7'347.91 | 4'682.85 | 15'860.96 | 29'609.97 | 1'285.48 |

| Trend | |||||||||||

| YTD | 4.06% | -2.51% | 16.93% | 23.02% | 17.31% | 27.74% | 13.74% | 24.67% | 23.06% | 7.89% | -0.45% |

(values from the Friday preceding publication)

So much hinging on real estate

Last week was relatively quiet for equity markets as investors digested the strong gains chalked up in October. Emerging markets are performing well, especially China, which put on 3% last week as real estate firms recovered. This came after Evergrande, China’s number-two property group, succeeded in paying the interest on its staggering EUR 260bn debt pile at the last minute.

Evergrande is taking every upcoming payment to the wire as it walks the bankruptcy tightrope. In recent months, the Chinese government has acted to curb property speculation and over-leveraging by sector firms. In other words, Evergrande is not the only one feeling the heat. The government’s message has certainly been heard and Evergrande is trying to cash in some of its assets, specifically selling holdings, to meet its commitments.

However, pressure on the real estate sector is being felt throughout Asia. The Asian high-yield bond index has plunged 30% since early June, a sign of the stress facing this industry. The prospect of bankruptcy continues to hover over Evergrande. If that happened, Chinese growth as a whole could take a knock. Evergrande’s last-minute payment, coupled with an official press release announcing a relaxation of lending conditions for real estate companies, injected some calm on Friday, leading corporate debt higher in Asia in its wake.

Inflation and the potential impact on interest rates remains the hot topic of the moment. There are several reasons why it is likely to linger for longer than central bankers expect. In the US, October inflation sped up to 6.2% year-on-year, the highest reading since the 1990s. Hourly wages in the US have also jumped. Chinese inflation figures also clocked in above expectations for October, at 1.5%, accompanied by a 13.5% increase in producer prices. Food prices are now surging following the sharp rise in commodities.

Higher inflation is a corollary of the more sustained recovery in economic growth, arising from an imbalance between rocketing demand and supply chains that are constrained by bottlenecks. Most companies are in a much better position than previously to pass on such price increases to consumers, whose savings ratios are at all-time highs. Conditions are therefore much healthier in the stagflation-dominated 1970s, with which some have tried to draw parallels.

US dominates global equity indices

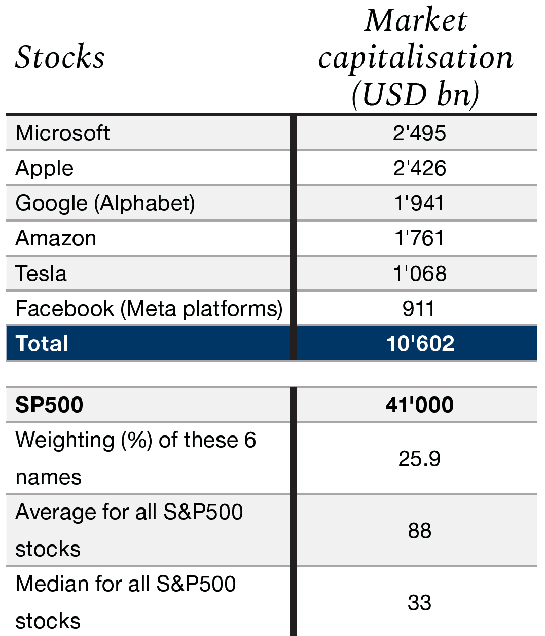

Last week Google briefly joined Apple and Microsoft in the select club of companies with a market capitalisation exceeding USD 2 trillion. These days, the capitalisation of the US market represents two-thirds of the global benchmark index, the MSCI World, although contrary to its name, the MSCI World does not include the 10% or so weighting that emerging economies represent.

In short, America remains preponderant. Yet this status derives from a relatively small number of household names. The main heavyweights in the US equity market are Microsoft, Apple, Google, Amazon, Tesla and Facebook, which today account for a thumping 25% of the US index. Their meteoric rise has driven a historic concentration move on the index. These six stocks, representing just over 1% of shares listed on the US market, have contributed almost 40% of the index’s appreciation over the past three years. The ‘smallest’ in terms of capitalisation (namely Facebook, now called Meta Platforms Inc.) today outweighs Nestlé, Roche and Novartis put together.

The six companies mentioned above have a combined market capitalisation of over USD 10 trillion, compared with the median size of S&P500 companies, which is only USD 33 billion. The dominance of these few stocks must be taken into account when allocating funds, because their upswings and downswings will have a major influence on the US index and, in turn, on global indices.

Flash boursier

Flash boursier