10/01/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.04 | 12'797.94 | 4'305.83 | 15'947.74 | 7'219.48 | 7'485.28 | 4'677.03 | 14'935.90 | 28'478.56 | 1'226.10 |

| Trend | |||||||||||

| YTD | 0.69% | 0.60% | -0.60% | 0.17% | 0.40% | 0.93% | 1.36% | -1.87% | -4.53% | -1.09% | -0.48% |

(values from the Friday preceding publication)

Fed turns up the heat

The main news last week was the release of Fed minutes from its last policy meeting of 2021, in mid-December, indicating that monetary tightening could be faster and more significant than expected. The surge in inflation to 6.8% in November, coupled with the state of the labour market, is encouraging Fed members to envisage action that is slightly more forceful.

On the menu for 2022 we can now expect the Fed to wrap up asset purchases as early as March. We can also look forward to a rise in the benchmark policy rate, which could occur as early as March too, with three rate hikes projected for the year. More surprising are possible plans to slim down the Fed’s balance sheet, which has mushroomed over the past decade in response to the multiple doses of quantitative easing administered.

Based on latest figures, this has swelled to USD 8.7 trillion, on a par with the GDPs of France, Germany and Italy combined. This novel element last week fuelled an upswing in the 10-year US government bond yield to a technically critical 1.79%. Equity markets were taken aback and hit by a sudden bout of sector rotation, with richly valued growth stocks losing out to value stocks, trading on much lower multiples. The entire financials sector also welcomed the news by chalking up strong performances.

Concerning the pandemic, the WHO last week confirmed that the new Omicron variant had now reached every continent but stated that symptoms are less severe compared to previous variants. While this is obviously good news from a healthcare perspective, the rate at which its spreads and contaminates individuals outpaces any of its predecessors. This has resulted in swathes of people going missing from their workplaces, with no sign of an end to this tendency.

Early indications as to the economic impact of quarantine-related absenteeism point to a decline in spending in the US restaurant and hotel sector and frequent labour shortages in industries in which working from home is not feasible. GDP for the first quarter of 2022 could be impacted negatively.

SNB: another year of solid results

The Swiss National Bank (SNB) has published provisional 2021 financials. For 2021, profit is expected at CHF 26 billion. At first glance, the final quarter of 2021 was poor, consisting of an estimated loss of around CHF 15 billion.

Q3 2021 still showed a profit of CHF 41 billion. The main reason for the detrimental performance in the fourth quarter was appreciation in the Swiss franc versus the euro, against which it rose by almost 4% over the period. It was also up by 2% against the US dollar. Another reason may have been the broad-based rise in interest rates during the fourth quarter.

It looks like 2021 will again be a highly positive year overall, with reserves available for distribution expected to exceed CHF 100 billion. The cantons and the Confederation are expected to receive a maximum pay-out of CHF 6 billion for the year (cantons 2/3, Confederation 1/3).

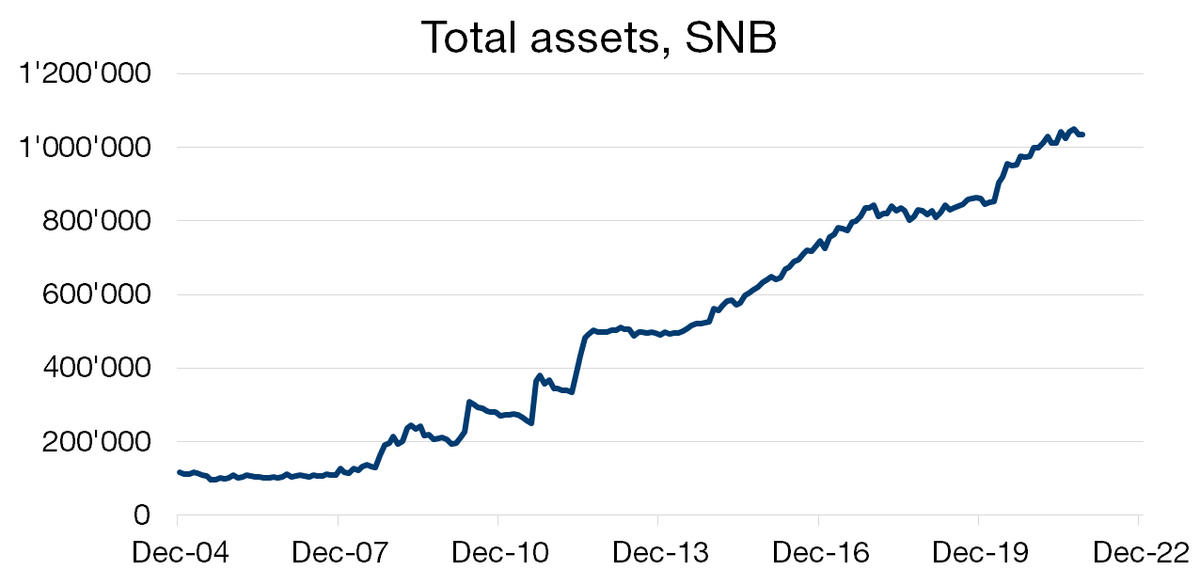

The size of the SNB’s balance sheet has increased dramatically in recent years and now exceeds CHF 1 trillion, as shown on the chart opposite. Evidently, with such a large balance sheet, market fluctuations – both upwards and downwards – have huge impacts in absolute terms. Final full-year financials will be reported in early March.

Flash boursier

Flash boursier