17/01/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.91 | 1.04 | 12'525.63 | 4'272.19 | 15'883.24 | 7'143.00 | 7'542.95 | 4'662.85 | 14'893.75 | 28'124.28 | 1'257.46 |

| Trend | |||||||||||

| YTD | 0.20% | 0.60% | -2.72% | -0.61% | -0.01% | -0.14% | 2.15% | -2.17% | -4.80% | -2.32% | 2.07% |

(values from the Friday preceding publication)

Equities stage correction

Major equity markets corrected last week, driven down by fears of faster rate hikes, potential upsets from earnings season and the spreading Omicron variant. The selling mainly targeted industrial and technology stocks. By contrast, emerging markets performed positively, with the broad index adding 2.5% over the week, helped along by a weaker dollar. Oil-related stocks have continued gaining as we head into the new week, just as the Saudi energy minister said he was not concerned about the level of crude oil prices.

Inflation has spread and started to bite to a degree not at all expected. More than half of its price components are rising by upwards of 5% year-on-year. Headline inflation could therefore remain above the Fed’s 2% target for a long time, which complicates matters for the central bank. Following record consumer and producer price data in December, the Fed now looks set to raise the benchmark policy rate three times in 2022, as soon as the bond purchasing scheme has been wound down. But some are even thinking that there will more rate hikes in store, and that is worrying investors.

Kicking off the quarterly earnings season, US banking majors delivered above-consensus results but of variable quality. Wells Fargo saw its profits jump 85% on the back of increased demand for loans. JP Morgan and Citigroup reported a 26% and 14% drop in earnings, respectively, on a weakening of trading income. Asset management colossus Blackrock saw its assets surge by 15% to new heights, topping USD 10 trillion.

China’s Q4 2021 GDP was higher than expected at 4% year-on-year but it nonetheless slowed relative to the previous quarter. Industrial production rose by 9.6% year-on-year, but consumer spending and property sales weakened. The Chinese economy is currently facing a triple whammy in the shape of a supply shock, a contraction in demand and issues triggered by debt-laden property companies. The People’s Bank of China has therefore come to the rescue, the signature measure being a 10bp cut in the 12-month lending rate to 2.84%. One of the stated goals is to limit the cost of borrowing to encourage households to gear up.

Nasdaq – seeing things another way

Equity markets had a good 2021, with indices stretching to record highs on several occasions. However, appearances can be deceiving. If we peek below the surface, the story is not the same for everyone. Massive dispersion exists across the market.

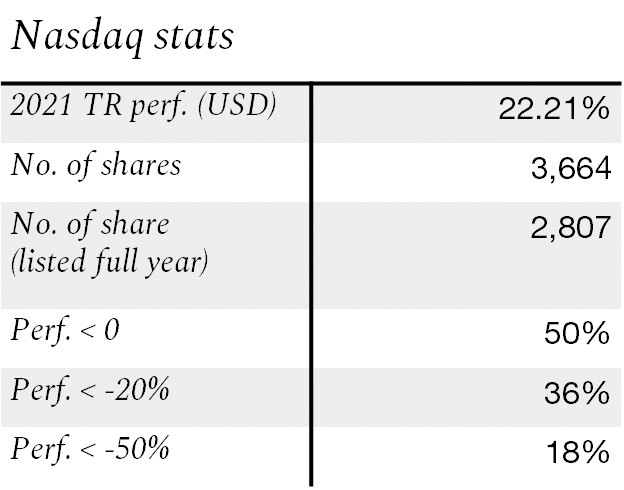

Of the 3,664 stocks making up Nasdaq, only the top ten had any real influence on its performance. The index owes its 22% performance in 2021 mainly to stocks such as Google (65%), Microsoft (52%), Apple (35%) or Nvidia (125%).

If we consider Nasdaq stocks listed for the full 12 months (2,807 stocks), 50% of them chalked up a negative performance. Of that number, one-third shed more than 20% of their market value and one-fifth more than 50%. This shows how easily it is to skew index performance. They cannot be said to truly reflect the reality of the market.

The same holds true in Switzerland, where the performance of the SMI is dependent on three household-name stocks: Roche, Nestlé and Novartis. For US indices, GAFAMs call the tune.

It is therefore important not to be blinded by headline index performance and always be aware of what is happening below the surface. Looking at the detail shows highly variable performances by the index constituents. Fund managers must act wisely but also cautiously in their stock selection to avoid underperforming their benchmark.

Flash boursier

Flash boursier