02/05/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.97 | 1.03 | 12'128.76 | 3'802.86 | 14'097.88 | 6'533.77 | 7'544.55 | 4'131.93 | 12'334.64 | 26'847.90 | 1'076.19 |

| Trend | |||||||||||

| YTD | 6.54% | -1.05% | -5.80% | -11.53% | -11.25% | -8.66% | 2.17% | -13.31% | -21.16% | -6.75% | -12.65% |

(values from the Friday preceding publication)

What is fuelling runaway inflation in the US and the Eurozone?

As we headed into 2021, inflation was clocking only 2% and 1% in the US and the Eurozone, respectively. By March, this had climbed to 8.5% and 7.4% – dizzy heights not seen since the early 1980s.

How did it come to this? First of all, by locking everyone in at home in response to the pandemic, governments triggered a drastic reduction in the supply of goods and services. At the same time, ultra-loose monetary policies in the form of zero interest rates and quantitative easing combined with fiscal assistance (such as the generous cheques sent to American households) stoked demand for these same goods and services. So it’s not surprising to see inflation emerging.

Later on, pressure to transition to clean energy has led to decreased spending on exploring for new fossil fuel deposits, resulting in a slower uptrend in production output. This has also triggered a sharp increase in demand for gas, which is used as a back-up in power generation whenever wind turbines and photovoltaics are not supplying energy. In a nutshell, this resulted in a supply-demand imbalance, which in turn sent hydrocarbon prices sharply higher, particularly as concerns gas in Europe, where more resolute efforts are being made to decarbonise the economy.

Then came the war in Ukraine and the subsequent sanctions against Russia, which have choked the supply of several types of commodity – from energy and softs to metals and ores.

Lastly, China remains hell bent on stamping out the highly contagious omicron variant, which is dampening the production of manufactured goods.

Q1 results in the US fail to reassure investors

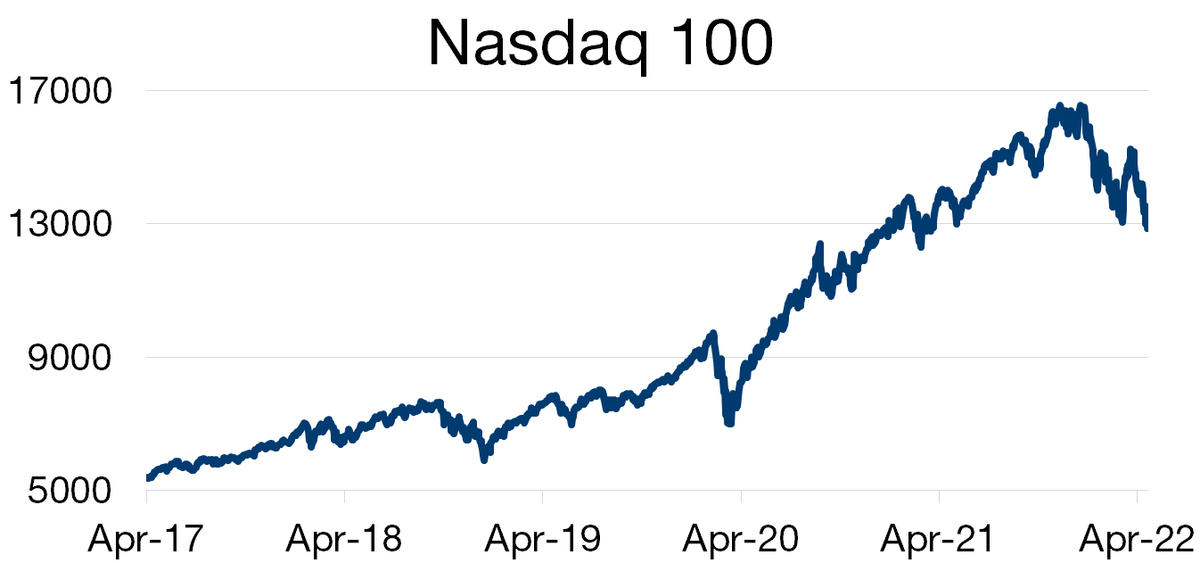

Despite a lull on the bond front across the Atlantic (T-Bond yield up by only 5 and 4 basis points on the 2- and 10-year maturities), which has been the main source of equity market turbulence so far this year, the S&P 500 suffered 3.3% drawdown last week, bringing the year-to-date decline to 13.3%. At first glance, because the financial results of US companies are respectable. Of the 275 companies that have reported so far, 80% have performed better than expected. In summary, Q1 profits are up 10% year on year, which is better than the 6% analysts expected in early April, just before the first figures started appearing. However, this broad positive trend masks upsets from among major tech players.

Amazon’s results and guidance fell way short of expectations due to the poor performance of its core e-commerce business, which is suffering from slower growth after the ending of lockdowns and from plant and human infrastructure that is now oversized.

Intel was punished for its lacklustre guidance, as momentum seeps out of the PC market – especially at the low end, which had benefited enormously from the working-from-home boom during the pandemic.

Google’s results were a mixed bag. Revenues are still on the rise, but investors were expecting brisker growth. The upset stemmed from Europe and YouTube, where advertising revenues failed to live up to analysts’ targets. This was due to a cautious mood among European advertisers in response to the war in Ukraine, increased competition from TikTok, and stricter rules from Apple and the EU on ad targeting.

Apple’s Q1 financials beat expectations but guidance fell short. The group warned that China’s zero-covid policy would have a significant negative impact on its current-quarter revenue.

Given that the S&P 500’s extraordinary performance since the spring of 2020 was primarily fuelled by tech giants, it is not surprising that recent underperformance by this cohort is now weighing on investor sentiment.

Flash boursier

Flash boursier