20/06/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.97 | 1.02 | 10'451.31 | 3'438.46 | 13'126.26 | 5'882.65 | 7'016.25 | 3'674.84 | 10'798.35 | 25'963.00 | 1'004.63 |

| Trend | |||||||||||

| YTD | 6.33% | -1.87% | -18.83% | -20.01% | -17.37% | -17.76% | -4.99% | -22.90% | -30.98% | -9.82% | -18.46% |

(values from the Friday preceding publication)

Rate hikes all the rage!

Last week ended on a negative note following a spate of rate rises by central banks, primarily in the US, UK and Switzerland.

The prospect of a recession in the US is becoming increasingly likely in the minds of investors following the Fed’s historic hike of 75 basis points (bp) on Wednesday. For the current year, it has raised its inflation forecast to 5.2% and cut its growth forecast to 1.7%, down from 2.8%.

The US economy was already on a downward track, with GDP having contracted by 1.5% in the first quarter. So far in the second quarter, it seems that the slowdown has continued in specific sectors such as manufacturing, real estate and retail sales. Treasury Secretary Janet Yellen has said that a recession is not inevitable, pointing to continued strong consumer spending and the robust job market. So there are still grounds to be positive on the world’s largest economy.

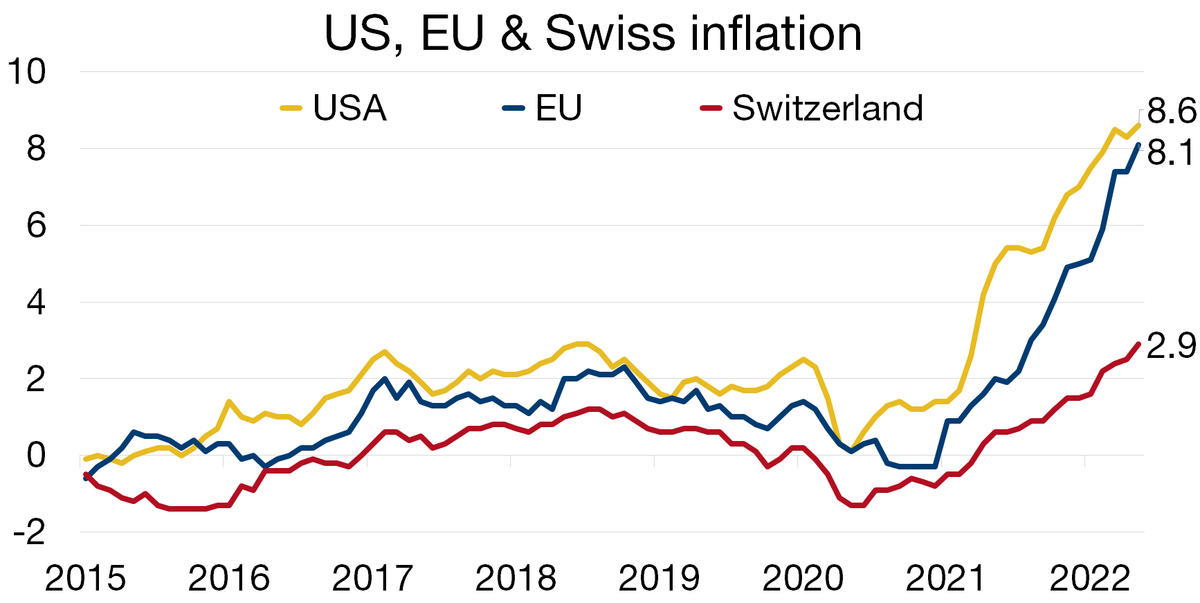

The surprise last week was sprung by the Swiss National Bank, which on Thursday morning raised rates by 50bp to -0.25%, preceding the European Central Bank (ECB) in tightening monetary policy. Chair Thomas Jordan announced that the decision was intended to prevent inflation from taking hold and spreading to a wider circle of goods and services, even though at 2.9%, it is still below the benchmark for the rest of the world.

Large-scale movements were last week seen in debt markets. For US paper, the curve connecting 5- and 10-year yields inverted, reflecting fears of recession, while the 2-year yield momentarily reached 2.27%, a level not seen since 2008. In Europe, the yield on the Italian 10-year bond climbed above 4% for the first time since 2014, at the height of the debt crisis. Greece’s paper is yielding 270bp more year to date (versus 250bp for Italy).

The surge in peripheral bond yields and spread widening, notably between the Italian 10-year and the Bund, prompted the ECB to hold an emergency meeting, after which it announced it would be flexible on PEPP reinvestments (pandemic emergency purchase programme) to help prevent spreads between core and peripheral debt widening. Currently, investors are anticipating a more hawkish ECB planning a string of rate hikes between now and the end of the year.

The market is losing patience with inflation and is worried about just how solid growth actually is. Since May, equity indices have given up 10%, or more in places. The spectre of stagflation is looming ever larger.

Macroeconomic forecasts revised down

The clouds are gathering for the Swiss economy, forcing the Economic Affairs Secretariat to revisit its macroeconomic forecasts. The main culprits for the deteriorating outlook are the war in Ukraine, which is having a harsher impact than expected, and China’s economic growth prospects, which have been weakened by the renewed lockdowns.

But while growth forecasts for 2022 have again been revised downwards, inflation estimates have also been raised. Swiss GDP growth is expected to clock in at 2.5%, down from 2.8% previously, while inflation is expected at 2.8% in 2022 (and 1.9% in 2023). But these estimates assume that the global economy will continue to expand and the war in Ukraine will not escalate.

The spread of inflation beyond commodities and supply-constrained sectors last week prompted the SNB to act, getting ahead of the ECB in its monetary tightening. It surprised the markets on Thursday morning by raising its key rate by 50bp to -0.25% – the first increase since 2007. The SNB also left the door open to further increases to stem inflation, which is expected to continue proliferating.

Thomas Jordan also stated that the Swiss franc was no longer richly valued after recent depreciation but that the SNB was ready to wade into the markets to prevent excessive fluctuations. The strength of the Swiss franc had earlier helped mitigate the impact of inflation in Switzerland, capping the rise in import prices for fuel and food, but is proving less effective in this task at the moment.

The rise in policy rates will have an impact on mortgage rates. The benchmark Saron rate is forecast at -0.51%, down from -0.69% in March, and is expected to move into positive territory some time in the next 12 months.

Flash boursier

Flash boursier