08/08/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.96 | 0.98 | 11'123.07 | 3'725.39 | 13'573.93 | 6'472.35 | 7'439.74 | 4'145.19 | 12'657.55 | 28'175.87 | 1'002.87 |

| Trend | |||||||||||

| YTD | 5.44% | -5.60% | -13.61% | -13.33% | -14.55% | -9.52% | 0.75% | -13.03% | -19.10% | -2.14% | -18.60% |

(values from the Friday preceding publication)

Recession or no recession – that is the question

The Fed’s recent rate hike – consisting of another 75 basis points – did not have a destabilising effect on financial markets. For one, the increase was widely anticipated. Secondly, comments by Jay Powell were interpreted positively, perhaps even a little too positively, after he stated that the pace of rate increases might have to be slowed to assess how inflation and the economy have thus far been impacted. The reaction by bond markets was radical, sending long-term yields tumbling. Some interpreted the Fed chair’s remarks to mean a possible rate cut as early as the beginning of next year. This prospect was summarily denied by several Fed members, who indicated that the road to bringing down inflation would be long. Market expectations also seem overly optimistic. Inflation is set to fall as the base effect wanes, but not as quickly as expected.

Wheat prices have returned to pre-war levels thanks to an agreement between Russia and Ukraine, and petrol prices have begun a correction. The same applies to the price of crude oil, which is back trading below USD 100 per barrel in Europe and USD 89 per barrel in the US. Dragging the price of oil down is the fact that the US economy has technically entered a recession, which will have a downward impact on demand. In contrast, the decline in inflation will be gradual, meaning that the Fed will want to see constant improvement in this metric before giving precedence to economic growth – its main area of concern before the pandemic struck. We do not foresee rate cuts from the Fed until at least the second half of 2023.

The US economy’s possible shift into recession mode still requires official confirmation. Despite two consecutive quarterly contractions in GDP, a committee of eight economists – the Business Cycle Dating Committee – gets to decide whether or not the economy is or was ever ‘in recession’, looking not only at GDP growth but also business investment, wage levels and unemployment. In that respect, the US job market remains extremely solid, as illustrated by non-farm payrolls last Friday, showing that 528,000 jobs were added in July. That was twice as many as expected.

On the strength of those numbers, it is not far-fetched to conclude that the US economy is not in recession. Whether the noun ‘recession’ receives official sanction is a secondary consideration. History shows highly disparate stockmarket performances during recessions and in the six months preceding them. In about half of all cases, equity indices actually gain ground.

SNB in the red

The Swiss National Bank reported first-half results showing a swing deep into negative territory as it suffered a loss of CHF 95.2 billion. This compares with a profit of CHF 48 billion in the same period last year. As a result, the Swiss cantons may have to forgo their usual payments this year.

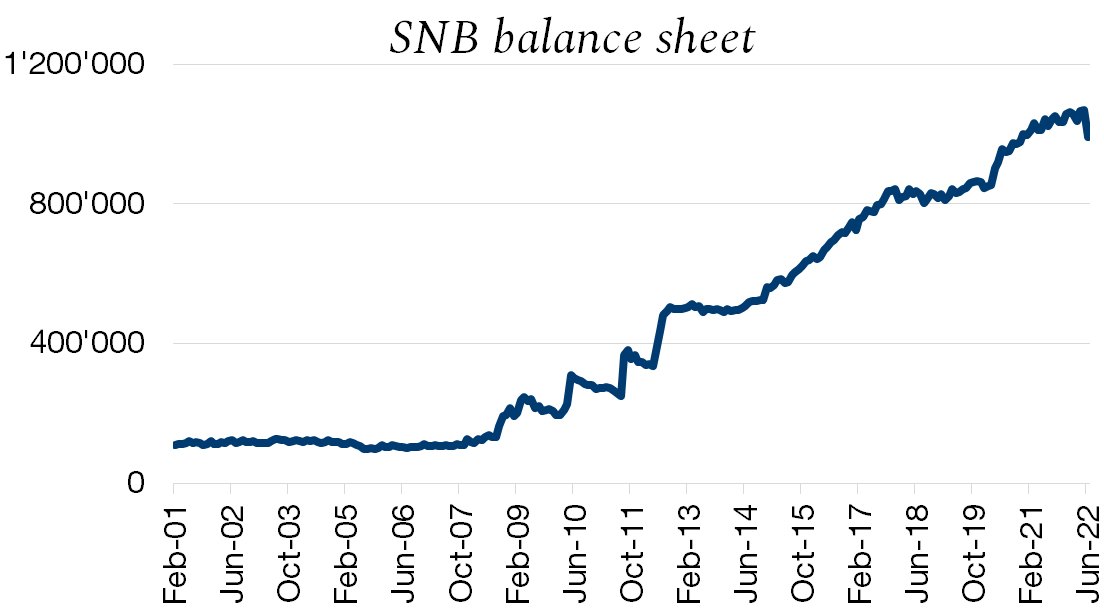

When it was trying to cap the value of the Swiss franc, especially against the currency of its main trading partner, the EU, and maintain price stability, the SNB let foreign currency reserves on its balance sheet swell to unprecedented proportions. Its balance sheet today represents 1.3x Switzerland’s GDP, compared with 0.4x and 0.6x GDP US and Europe, respectively.

High exposure to foreign currencies was disastrous for the first half of 2022, costing the SNB more than CHF 97 billion compared with interest and dividend income of around CHF 5 billion. The loss was offset by the Swiss franc positions, which generated a profit of CHF 35 million, and gold reserves, which yielded CHF 2.4 billion.

In its press release, the SNB pointed out that its result depends mainly on developments in foreign exchange, capital and gold markets, and strong fluctuations are to be expected. It is therefore impossible to make projections for the full year, it concluded.

According to analysts at UBS, if the loss remains at these dizzy heights, i.e. at over CHF 93 billion, the cantons may have to forgo their usual annual payments from the SNB.

Flash boursier

Flash boursier