28/11/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.95 | 0.98 | 11'168.03 | 3'962.41 | 14'541.38 | 6'712.48 | 7'486.67 | 4'026.12 | 11'226.36 | 28'283.03 | 941.01 |

| Trend | |||||||||||

| YTD | 3.69% | -5.21% | -13.26% | -7.82% | -8.46% | -6.16% | 1.38% | -15.53% | -28.24% | -1.77% | -23.62% |

(values from the Friday preceding publication)

Business indicators soothe investor nerves

The rally continued last week in equity markets as evidence grew in support of slower rate hikes by the Fed, with a range of figures pointing to slowly worsening economic conditions.

Bond yields continued easing, with the US 10-year yield at around 3.7% and the Bund at 1.90%. Oil fell by more than 4%, with WTI ebbing to USD 74 and Brent to USD 81.

Additionally, a handful of upbeat business indicators allayed investors’ concerns about a sharp slowdown in growth. Highlights included the 1% increase in durable goods orders and the 7.5% recovery in new home sales in October. US consumer confidence deteriorated in November but this was less than initially announced: the index was revised to 56.8 from the initial estimate of 54.7.

In contrast, the contraction in the US private sector deepened in November according to the composite PMI, which clocked in at a preliminary estimate of 46.3 compared with 48.2 in the previous month.

Against this backdrop, investors welcomed the minutes of the latest Fed meeting highlighting the fact that many officials suggested that a slower pace of rate hikes would soon be appropriate.

On the employment front, initial jobless claims for the week ending 19 November advanced to 240,000, beating the forecast for 223,000.

The S&P 500 ended the week up by 2.02% while the tech-heavy Nasdaq, more sensitive to interest rate expectations, gained only 0.73%.

On the inflation front, German producer prices fell by 4.2% in October, contrasting with an expected 0.6% increase. Business sentiment improved in October as illustrated by a business climate index of 86.3, which beat the expected 85.0.

Eurozone economic activity also slowed less than expected in November. The manufacturing PMI improved to 47.3 versus 46, while the services PMI was static compared to the previous month at 48.6.

Market participants will this week be attentive to the Fed chair’s speech and inflation data.

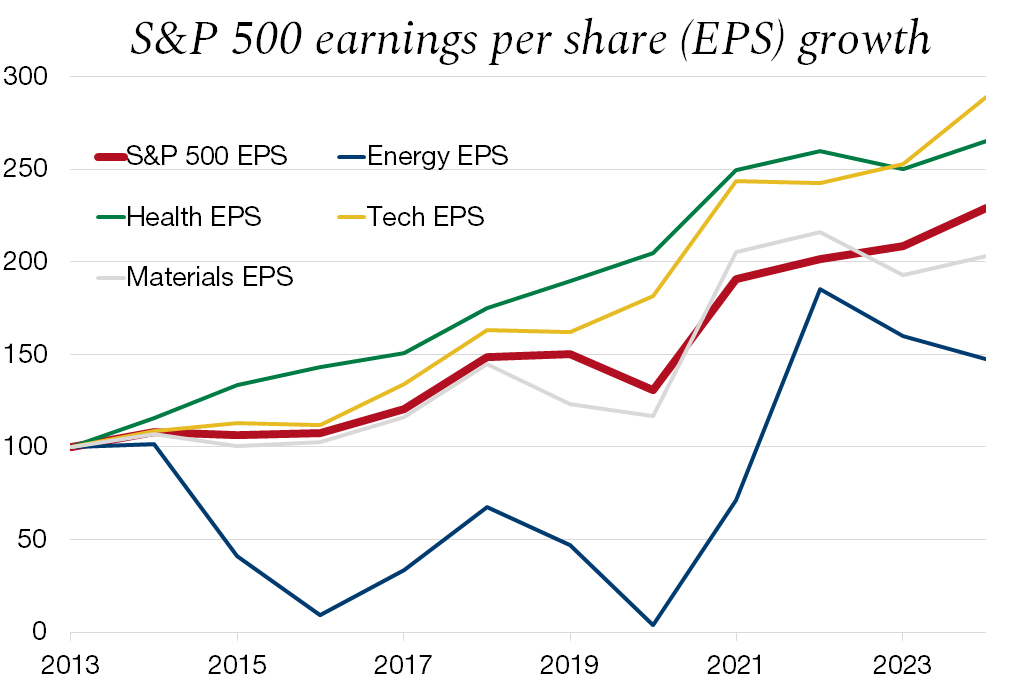

Earnings growth to stand still in first half of 2023

The spectre of recession has finally shown up in analysts’ estimates. Last month they were still forecasting S&P 500 earnings growth of 5.7% for 2023 but now expect earnings to contract in the first half of 2023 before reverting to growth in the second half of the year.

All sectors have suffered downward revisions for FY 2023. Most affected is tech, concerning which estimates for the first half of 2023 have shifted from 3.8% growth, in October, to a 1.3% contraction. It joins the club made up of energy, healthcare and materials, which had already been hit by a downgrade in their earnings growth outlook for next year.

At this stage, an earnings contraction is priced into analysts’ estimates for the first part of 2023. In contrast, cost-cutting and an upcycle are expected for the second half of the year, which should then drive a recovery, allowing the S&P 500 to end 2023 on earnings growth of around 3%, based on latest estimates.

Flash boursier

Flash boursier