16/01/2023

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.93 | 1.00 | 11'290.79 | 4'150.80 | 15'086.52 | 7'023.50 | 7'844.07 | 3'999.09 | 11'079.16 | 26'119.52 | 1'029.85 |

| Trend | |||||||||||

| YTD | 0.21% | 1.39% | 5.23% | 9.42% | 8.35% | 8.49% | 5.26% | 4.16% | 5.85% | 0.10% | 7.68% |

(values from the Friday preceding publication)

Inflation continues to slow

Equity markets ended the week on a positive note, with Powell’s ‘s address not triggering much of a reaction. The Fed chair actually refrained from commenting on rates after several committee members had suggested a peak rate hovering above 5% for some time. Eyes were instead on Thursday’s inflation figures, which continued to lose traction in line with expectations and the first batch of corporate earnings.

Conversely, the World Bank revised down its 2023 growth forecast to 1.7% versus 3% last June; and it expects only a moderate recovery to 2.7% in 2024.

Bond yields eased as investors bet on a less hawkish monetary policy in the months ahead. The US 10-year yields sits at 3.50% while the German 10-year has reverted to 2.15%.

US consumer prices ebbed by 0.1% month-on-month in December, declining for the first time since May 2020 following a drop in petrol prices. The CPI excluding food and energy correspondingly edged up by 0.3% versus +0.2% in November. Inflation has also been falling on a 12-month basis, slowing to 6.5% from 7.1% in November, marking the sixth consecutive decline and raising hopes for a more accommodating Fed when it next meets to examine rates. The market now expects a mere quarter-point increase in February.

Over in Europe, Germany is proving resilient, reporting zero GDP growth in Q4 and a 1.9% increase for the whole of 2022 despite the gas supply shock hurting the economy. UK GDP edged up by 0.1% in November versus October, raising the spectre of a technical recession in Q4 2022. Eurozone industrial production showed a modest recovery in November, rising by 1% month-on-month, confirming that it too is holding up.

Chinese CPI picked up some pace in December, quickening to +1.8% year-on-year, which was in line with expectations. Producer prices fell by more than expected, dropping by -0.7% compared with a forecast -0.1%. Shelving the zero-covid policy has triggered a wave of contaminations that could depress business activity in the short term and cap price increases, particularly in services.

The end of the week was enlivened by the start to reporting season, with US banks getting the ball rolling. Overall, business figures have been supported by higher interest rates, partly offsetting lower revenues from investment banking and asset management. But banks across the board have provisioned for a recession, which has left a bitter taste in the mouth of investors.

Following the slew of data, the S&P 500 ended the week up 2.67% while the tech-heavy Nasdaq advanced by 4.82%. The Stoxx 600 Europe index continues to recover and last week put on another 1.83%.

Energy

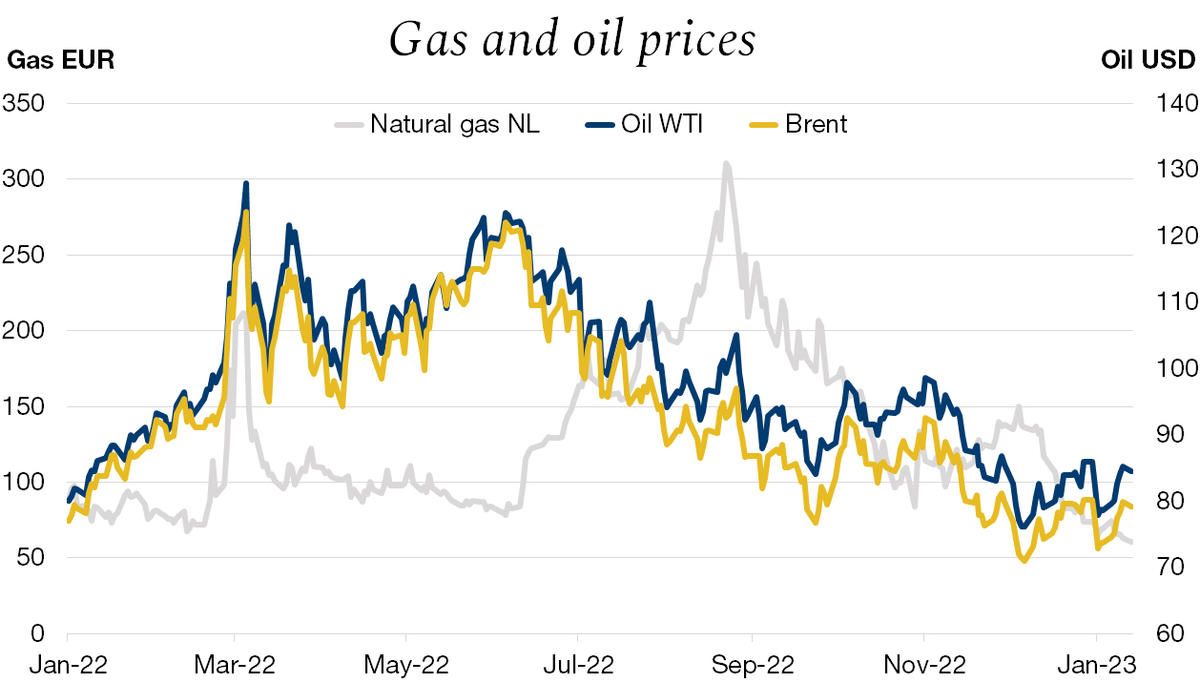

The inflation surge in 2022 – fuelled by rocketing power, oil and gas prices as global economies got back on their feet and Russia invaded Ukraine – seems to be nearing an end.

Amid the protracted military conflict, European leaders have taken the necessary steps to limit dependence on Russian gas by further diversifying sources of supply and introducing energy-saving plans.

The slowdown in global economic growth orchestrated by central banks, combined with milder-than-usual winter temperatures, have led to a sharp decline in gas prices in Europe, which is great timing just as central banks are seeking to curb inflation.

But a strong global economic recovery led by China could reverse the trend, meaning that energy prices could remain volatile.

Flash boursier

Flash boursier