Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 0.99 | 11'106.24 | 4'315.05 | 15'628.84 | 7'322.39 | 7'631.74 | 4'109.31 | 12'221.91 | 28'041.48 | 990.28 |

| Trend | |||||||||||

| YTD | -1.02% | 0.26% | 3.51% | 13.74% | 12.25% | 13.11% | 2.42% | 7.03% | 16.77% | 7.46% | 3.54% |

(values from the Friday preceding publication)

A broad-based slowdown in inflation, combined with easing fears of a banking crisis in the US and further signs of a bounce in the Chinese economy, have encouraged a risk-on mood in financial markets.

Bond yields have levelled off, with the US 10-year yield situated around 3.50% and the German equivalent is close to 2.30%.

US inflation has continued losing traction, with the consumer price index (PCE) up 0.3% month-on-month in February after a 0.6% increase in January. Year-on-year, the index rose 5.0% in February after an increase of 5.3% in January.

In addition, the larger-than-expected rise in weekly jobless claims has reinforced expectations that the Fed might take time out from its tightening cycle. The latest round of initial jobless claims rose by 7,000 in the week beginning 20 March to 198,000, up from 191,000 in the previous week.

Consumer confidence unexpectedly improved in March, with the index beating expectations and rising to 104.2, from 103.4 in February.

Eurozone inflation also slowed last month, with the European HICP up 6.9% year-on-year. The consensus forecast was for +7.1% and February’s rise was 8.5% year-on-year. However, core inflation, which excludes energy and unprocessed food, slowed only from 7.5% to 7.4%, versus a consensus forecast of 7.5%. We believe this may encourage the European Central Bank (ECB) to continue its monetary tightening. In Germany, consumer prices rose 7.4% year-on-year, a marked slowdown from January’s 8.7% increase.

China’s economy continued recovering in March, with manufacturing activity still growing rapidly and the service sector delivering a strong upturn. The purchasing managers index (PMI), reflecting the welfare of the country’s manufacturing activity, stood at 51.9 points compared with 52.6 in February. The services index rose sharply to 58.2 in March, up from 56.3 in February.

In this supportive context, the S&P 500 ended the week up 3.48% while the tech-heavy Nasdaq swung upwards by 3.37%. The Stoxx 600 Europe index rose by 4.03%.

In the coming week, market participants will be looking at unemployment figures as well as the ISM manufacturing and ISM services figures in the US.

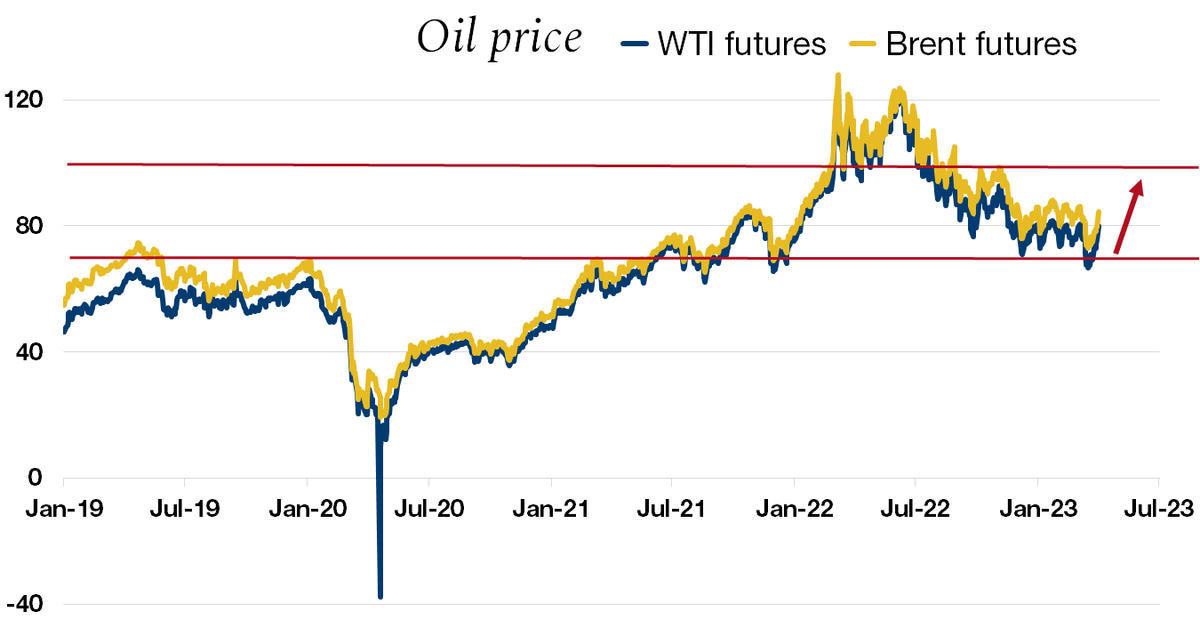

Oil jumped 8% on Monday morning after OPEC+ announced it would cut production by more than 1 million barrels a day, abandoning assurances that it would keep supply stable to protect at-risk global economic activity.

This surprise decision could jeopardise central banks’ fight against broad inflation by stoking inflationary pressures and forcing them to keep interest rates high for longer.

Previously, oil had fallen nicely back to pre-pandemic levels after trading above $100 for much of 2022. Recent moves contributed significantly to bringing down inflation. The impetus from alternative energies such as photovoltaics and the electrification of the automotive sector, coupled with a decrease in demand due to weakening global growth, were the main reasons for massaging oil prices higher. More recently, the turmoil from the banking crisis had pushed oil prices to a 15-month low short of $70.

However, China’s reopening has added a counterweight, allowing the price of oil to hold up. This supply cut and the resulting rise in oil prices have pushed the global economy back towards recession and further inflamed relations between the US and OPEC+ countries, which were already fragile after last October’s production cut.

The volatility in the oil market is therefore not over and risks undermining the progress made so far against inflation and the forecasts for the duration of restrictive monetary policy.

Flash Boursier im PDF-Format herunterladen

Dieses Dokument dient ausschliesslich zu Informationszwecken. Die Daten stammen aus verlässlichen und aktuellen Quellen. Für die Vollständigkeit und Richtigkeit der Angaben wird jedoch keine Gewähr geleistet. Finanzmärkte und Finanzprodukte unterliegen naturgemäss hohen Verlustrisiken, die sich als nicht vereinbar mit der Risikotoleranz des Lesers erweisen können. Aus dem allenfalls in diesem Dokument aufgeführten bisherigen Leistungsausweis kann nicht auf die zukünftige Performance geschlossen werden. Dieses Dokument stellt keine Empfehlung und kein Angebot zum Kauf oder Verkauf von Wertpapieren oder anderen Finanzprodukten für den Leser dar, und es können daher in keinem Fall Haftpflichtansprüche für die Bank daraus abgeleitet werden. Die Bank behält sich gegebenenfalls das Recht vor, von den Empfehlungen in diesem Dokument abzuweichen, insbesondere im Rahmen der Vermögensverwaltungsmandate für ihre Kunden und bei der Verwaltung von bestimmten kollektiven Anlagen. Die Bank ist eine Schweizer Bank, die der Aufsicht und Regulierung der Eidgenössischen Finanzmarktaufsicht (FINMA) untersteht. Sie verfügt nicht über die Bewilligung einer ausländischen Aufsichtsbehörde und wird auch von keiner solchen beaufsichtigt. Folglich können der Vertrieb dieses Dokumentes ausserhalb der Schweiz sowie der Verkauf von bestimmten Produkten an Anleger mit Wohnsitz ausserhalb der Schweiz gewissen Beschränkungen oder Verboten gemäss ausländischem Recht unterliegen. Es obliegt dem Leser, sich diesbezüglich über seinen Status zu informieren und die ihn betreffenden Gesetze und Vorschriften einzuhalten. Wir empfehlen Ihnen, sich an ausgewiesene Spezialisten in der Rechts-, Finanz- und Steuerberatung zu wenden, um Ihre Position im Verhältnis zum Inhalt dieser Publikation abzuklären.