21/06/2021

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.10 | 11'941.25 | 4'083.37 | 15'448.04 | 6'569.16 | 7'017.47 | 4'166.45 | 14'030.38 | 28'964.08 | 1'361.25 |

| Trend | |||||||||||

| YTD | 4.32% | 1.25% | 11.56% | 14.94% | 12.61% | 18.33% | 8.62% | 10.93% | 8.86% | 5.54% | 5.42% |

(values from the Friday preceding publication)

Change in tone

The main event last week was the less dovish message from the Fed, which is now considering raising rates sooner than expected. Of the 18 FOMC members, 11 forecast two hikes by 2023 – needed to prevent the economy from overheating. Accordingly, the Fed raised its 2021 growth forecast from 6.5% to 7%. It also upped its inflation projection to 3.4% while issuing a reminder that the upswing would probably be short-lived and suggesting that inflation would stabilise at 2% in 2022.

Demand is brisk and supply bottlenecks have become commonplace, stoking sharp increases in production costs. Prices of goods that proved popular during the pandemic, such as second-hand cars, have continued climbing. The Fed chair remains comfortable with a ‘transitory’ price spike, whilst investors are worried about tightening and what this might mean for interest rates. But before that happens, full employment must be attained. And according to last week’s jobless claims, which ticked upwards after receding for eight weeks, we are still far from such an achievement. US employers are facing a labour shortage. They are therefore happy to raise wages to get people back to work, which is fuelling inflation even more. In its message, the central bank sought to reassure by stating that a solid recovery is in progress, adding that it will continue to communicate any new measures ahead of time. In contrast, the Fed has started talking about tapering asset purchases, which are currently set at USD 120bn per month. ‘Tapering’ is one of the market’s main bugbears at the moment. Yet all depends on the Fed making substantial progress towards its inflation and full-employment targets.

Despite the hawkish comments from Philly Fed boss James Bullard, US bond yields ebbed to around 1.40% after rising to 1.59%. In contrast, this strengthened the dollar and correspondingly undermined the prices of base metals.

In Europe, economic growth is clearly picking up pace, but inflation is more subdued, miles below the official 2% target. The ECB continues to plough stimulus into the economy but now much more urgently. European markets are beginning to catch up, judging by the record inflows into European stocks.

The Fed’s change in tone is indicative of an economy that is still recovering but whose pace could slow. Meanwhile, Europe is catching up and luring investors back to the fray.

Capex back in fashion

As the global economy recovers strongly, companies are increasing their spending, with a sharper focus now on business investment and expansion as opposed to returning cash to shareholders. That is good news for economic growth.

The easing of pandemic-related restrictions has pushed up earnings estimates and lifted share prices. Now investors are on the lookout for the next catalyst. Higher capital spending could be just the ticket for the market to sustain its recovery. The main beneficiaries of the spending spree will be capital goods, oilfield services, technology, materials and automotive groups with their own dealer networks.

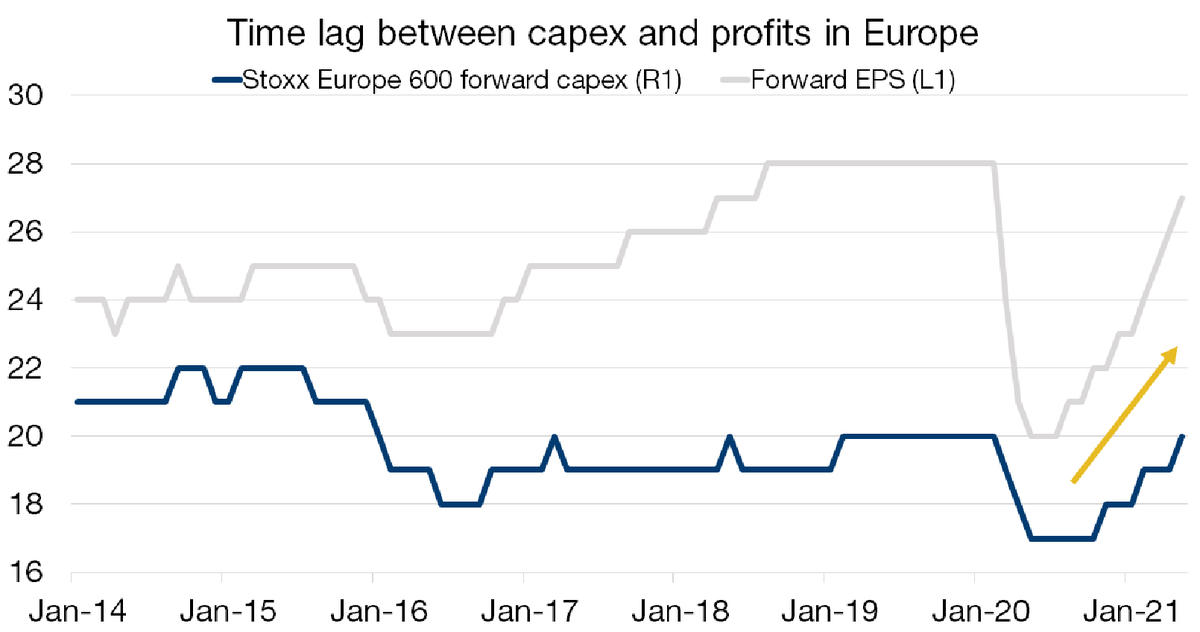

Increases in business investment tend to lag upturns in profits, and this time things should not be different. Helped by cash-rich balance sheets and easy borrowing terms, the statistics show that investment intentions are higher than pre-Covid levels.

The massive budget plans announced by governments support this resurgence in capital spending. The energy transition and digital transformation remain the main areas of spending in Europe, and increased spending should logically galvanise the catch-up rally by European equities. Strong investment growth is expected in 2021 and 2022, which will doubtless make a positive contribution to real GDP growth in the EU.

Flash boursier

Flash boursier