14/11/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.94 | 0.97 | 11'127.15 | 3'868.50 | 14'224.86 | 6'594.62 | 7'318.04 | 3'992.93 | 11'323.33 | 28'263.57 | 935.73 |

| Trend | |||||||||||

| YTD | 3.19% | -6.03% | -13.58% | -10.00% | -10.45% | -7.81% | -0.90% | -16.22% | -27.62% | -1.83% | -24.05% |

(values from the Friday preceding publication)

Monetary tightening may be nearing an end

The sharp fallback on risk premiums lifted financial markets last week following the release of lower-than-expected inflation figures, suggesting that Fed-led monetary tightening may be over sooner rather than later. Growth and high-leverage stocks were belle of the ball; defensive stocks consolidated their earlier gains.

In short, expectations for slower rises in interest rates encouraged bond yields to head south. For example, the US 10-year yield retraced below the 4% mark to around 3.80%. The yield on the German 10-year Bund is back at 2% level.

In the US, the midterm elections failed to produce a comeback for the Republicans. While they are expected to clinch a majority in the House of Representatives, the Senate will stay Democrat.

On the macroeconomic front, the US consumer price index (CPI) slowed to 0.4% in October. Year on year, this inflation metric advanced by 7.7% versus the forecast 7.9%, having shot up by 8.2% in September. Excluding food and petrol, the index slowed to 6.3%, down from 6.5%. Hourly earnings also fell by 2.8% in October, following a decline of 3% in the previous month.

On the labour market, the figures also showed a slight slowdown. Initial jobless claims clocked in higher than expected at 225,000 against a forecast of 220,000.

The S&P 500 ended the week up by a solid 5.90% while the tech-heavy Nasdaq, more sensitive to interest rate expectations, gained a massive 8.10%.

In Europe, German industrial production rose by 0.6% in September relative to August, beating the estimated 0.2% increase. However, output from energy-intensive activities fell by 0.9%. Inflation appears to stall in October. CPI was reported, as expected, at 11.60% after several months of steady increases.

Over in China, the government announced an easing on travel restrictions, leading to a sharp bounce in equity indices. This further supported positive momentum last week.

China

China seems intent on stamping out covid. Beset by rumours of a policy easing, Xi Jinping recently reaffirmed support for the zero-covid policy. Moreover, the evolution of the epidemic nationwide does not support the lifting of restrictions, according to the latest official figures.

However, economic statistics show a China that is suffering, which in itself should lead to a relaxation in some public health measures. The country seems to be getting ready for ‘business as usual’. Crude oil imports have increased by more than 2.5 million barrels per day in recent weeks.

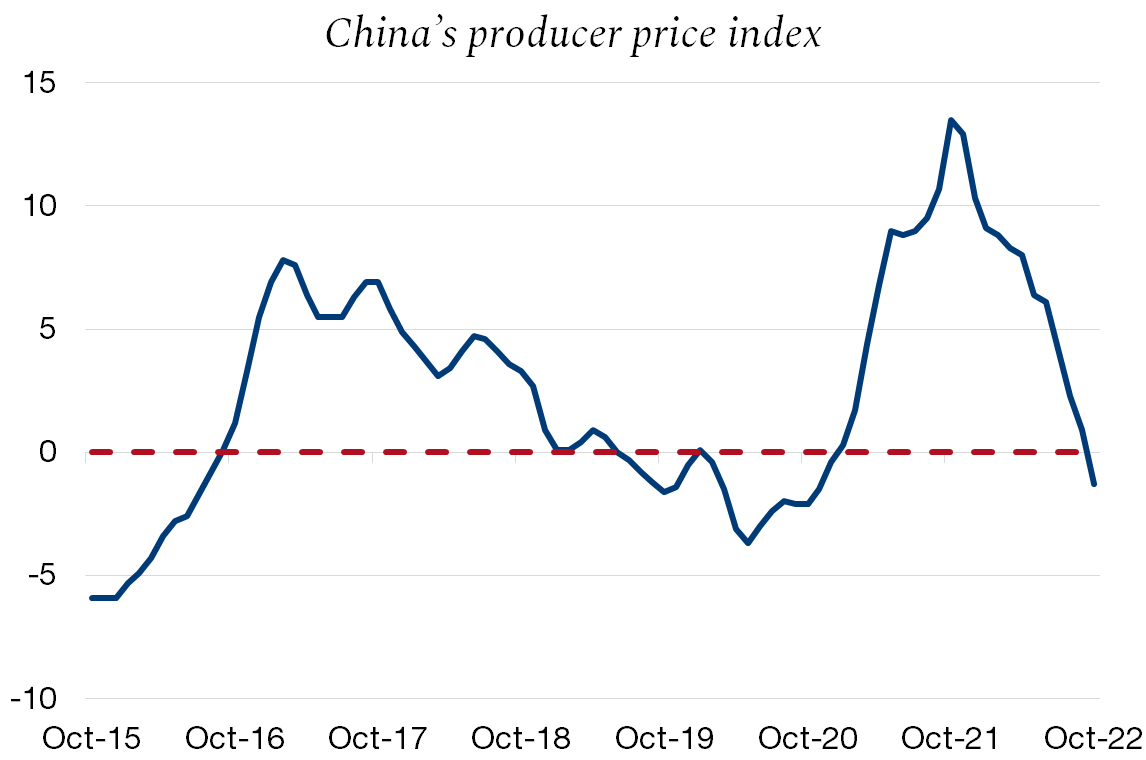

Producer prices slipped into deflation territory for the first time in almost two years, falling by 1.3% versus October 2021. Pandemic-related disruptions have dampened demand, and some commodity prices have fallen. Consumer price inflation slowed to an annualised 2.1% in October, following a 2.8% gain in September.

A China functioning as normal should provide support to markets, especially the semiconductor, luxury and consumer discretionary sectors. After all, it is the world’s second-largest economy. This was indeed witnessed when Beijing announced it was relaxing its quarantine rules for travellers and contact cases. The news delighted Chinese markets and European luxury stocks on Friday. At the opening bell, Kering and Hermès gained 3.5% and 6.5% respectively, before handing back some of their gains during the day. The strong bounce on these stocks followed the gains stemming from supportive US inflation news on the previous day.

The Chinese government has also drawn up a plan to support property developers in the face of an impending debt crunch as it tries to help out its ailing property market.

Any good news serves as a pretext for a market rally. The relaxation of lockdowns in China will probably be a lengthy process, although progress has definitely been made recently and this will support stocks exposed to the region.

Flash boursier

Flash boursier