Analyse October 2019

Currency wars: not as appealing as they might first appear

Currency wars are still being waged, as a way for countries to stay competitive. They initially seem effective, allowing countries to export a recession or economic downturn. However, they are not as appealing as they might first appear, because in the end they benefit no-one.

Exchange rates have often been used as a weapon during crises of capitalism from the 19th century to the present day. A country’s currency is its main way of interacting in the global trade system. It implicates all economic agents, influencing consumer spending, savings and investment.

Devaluation is the most popular tool with which to change this interaction. Common sense suggests that a weak currency is a good thing for a country’s foreign trade. The reasoning is that a falling exchange rate will boost exports and reduce imports. Devaluation makes locally produced products cheaper for foreign buyers, and so the country’s exports become more competitive. At the same time, because foreign products become more expensive and therefore less appealing, the country could even wipe out its trade deficit.

History has plenty of examples of devaluation. After the 1929 crisis, the United Kingdom abandoned the gold standard and devalued its currency by 40%. Around 20 countries followed suit. Since the 1970s, when the gold standard finally ended, devaluations have become more frequent. The United States, intent on boosting exports and stimulating the jobs market, has always been very active on this front. The collapse of the Bretton Woods system in 1971 meant that the dollar de facto became a major means of exchange and reserve currency. This meant that the United States could buy foreign goods by printing dollars and issuing debt. It is not the only country to use that method. China is more than prepared, when necessary, to devalue the yuan in order to steal growth from its trading partners.

Deceptively subtle

However, if devaluation were such a good idea, Japan would have a flourishing economy and the Bank of England, which has seen the pound slump because of Brexit, would not be worried about a recession. The relationship between the exchange rate and foreign trade is deceptively subtle. A weak currency has two main effects on relative prices and volumes. It leads to a degree of inertia in people’s behaviour – for example, business managers can use the situation to increase margins – and it can prove futile when the country’s trading partners respond in kind. It should also be noted that, for countries with large external debts, devaluation leads to higher interest payments and, over the long term, a sustained decline in the exchange rate affects credibility and trust in that currency, in a world in which capital is mobile.

Finally, the positive effects of devaluation are generally temporary. The benefits fade as prices rise – as net foreign currency inflows inflate the money supply – and the method causes higher inflation. Brazil is a good example. In 2010, it responded to a collapse in exports by weakening the real. Although this stabilized its trade deficit with the United States, higher prices hurt Brazil’s most vulnerable communities.

A strong currency also has its advantages

Conversely, a strong currency is not all bad news. It encourages companies to use their resources to increase innovation and productivity, and therefore their competitiveness. Swiss companies, for example, are condemned to excellence in order to deal with the long-term appreciation of the Swiss franc. Another factor in favour of a strong currency is that, for non-standardised products, criteria such as quality, durability and after-sales service are often more important than price.

In 1078, in “The Art of War” Chinese strategist Sun Tzu wrote that “there is no instance of a country having benefited from prolonged warfare”. This quote applies perfectly to a currency war. Because it is impossible for all countries to devalue their currencies at the same time, it is a type of war that ends up benefiting no-one, instead leading to increased economic uncertainty and political tension.

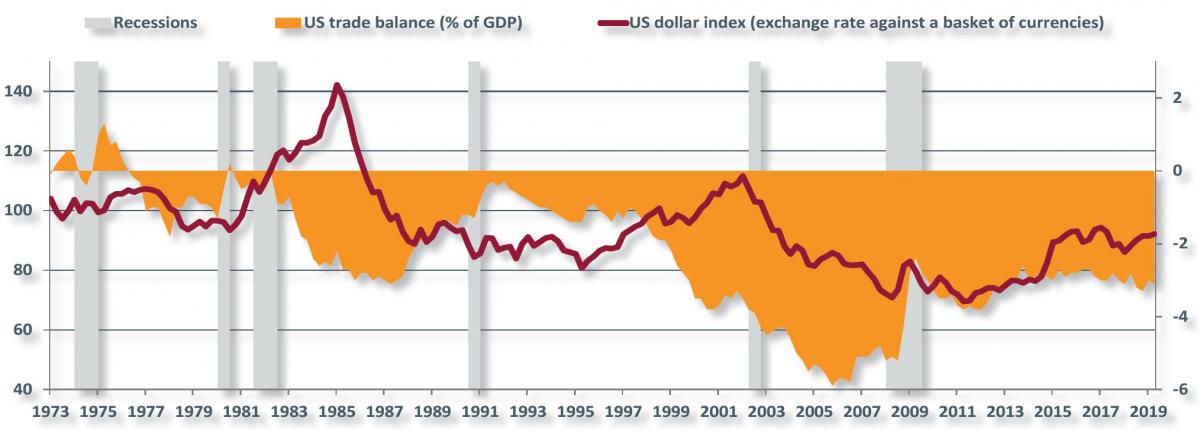

Fig. 1. US dollar and US trade deficit (% of GDP)

Source: Federal Reserve of St Louis

Bonhôte Group news

New hires

We are delighted to announce two new arrivals at the Bonhôte Group.

Patrice Raffy, who has a master’s degree in international relations and almost 20 years of experience in the banking industry, has joined our Geneva branch as a senior private client relationship manager.

Karine Patron, who has a master’s degree in finance from Neuchâtel University and a Certified Wealth Management Advisor diploma from the Swiss Association for Quality, has joined our discretionary asset management team.

Bonhôte Impact Fund

Our new Bonhôte Impact programme has got off to a successful start this year, attracting more than CHF 70 million of assets including CHF 30 million for the investment fund launched in 22 July. Through its investments, the fund aims to achieve a positive social and environmental impact as well as strong financial returns.It is available to the public with no minimum investment requirement, and its strategy can also be adopted for our mandate-based clients. If you would like to discuss the Bonhôte Impact fund, please contact your relationship manager. For more information, visit bonhote.ch/bonhote-impact.

Bonhôte behind the next sporting generation

Our programme of supporting the next generation of sportspeople has two new ambassadors. They are Alexandre Balmer, junior world mountain bike champion, and Sylvain Fridelance, silver medallist in the European U23 triathlon championships. To find out more, visit bonhote.ch/next-sporting-generation.

Garden Party

Click here to see the pictures of the event (in FR).

Analyse

Analyse