03/08/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.91 | 1.08 | 10'005.90 | 3'174.32 | 12'313.36 | 4'783.69 | 5'935.98 | 3'271.12 | 10'745.27 | 21'710.00 | 1'078.92 |

| Trend | |||||||||||

| %YTD | -5.65% | -0.89% | -5.76% | -15.24% | -7.06% | -19.98% | -21.30% | 1.25% | 19.76% | -8.23% | -3.21% |

Highlights:

1. US tech giants post robust earnings

2. American GDP marks historic decline

The ‘Fantastic Four’

Last week everything – or almost everything – revolved around the four giants of the US tech sector: Apple, Amazon, Facebook and Alphabet (parent company of Google). First of all, on Wednesday, the respective chief executives of these titans sat in the spotlight as they responded to accusations from Congress highlighting their alleged dominant positions and the potential misuses thereof.

This virtual hearing in the end sounded more like a list of grievances being read out than an attempt to build a constructive dialogue between government and the corporate world. Many documents were submitted as pieces of evidence criticising these groups’ practices, from both Democrats and Republicans. Yet this hearing is nothing more than the first episode in what is likely to be a long-lasting saga, simply because this congressional committee does not have the power to ‘bust’ monopolies, only to make recommendations for updating US antitrust law.

The following day, the same four groups released their second-quarter results. The numbers were quite simply awe-inspiring. The contrast is striking. As the pandemic spreads wildly, a global recession looms and record numbers of people line up at US unemployment offices, the growth record remains absolutely untouched. Amazon – to name but one – saw its top line surge by 40% in the second quarter, which some might say is understandable, because the widespread lockdown measures automatically boost the digital economy and the services on offer from those tech giants. But it’s still impressive.

On the macroeconomic front, it’s all gloom and doom. US GDP shrank by 10% in the second quarter. Such a huge decline has not been seen since the end of the Second World War. In Europe, the data have barely been more encouraging, with the Eurozone economy contracting by 12% relative to the first three months of the year. The countries hit hardest were Spain (-18%), France (-14%) and Italy (-12%).

If the European equities bear the hallmarks of the underlying angst, considering that the Eurostoxx 50 index is down 15% year to date, US markets are soaring ahead. But beware, the ‘Fantastic Four’ today account for 20% of the S&P 500 by value, and that is capping further upside. For how long the US will continue outperforming is anybody’s guess…

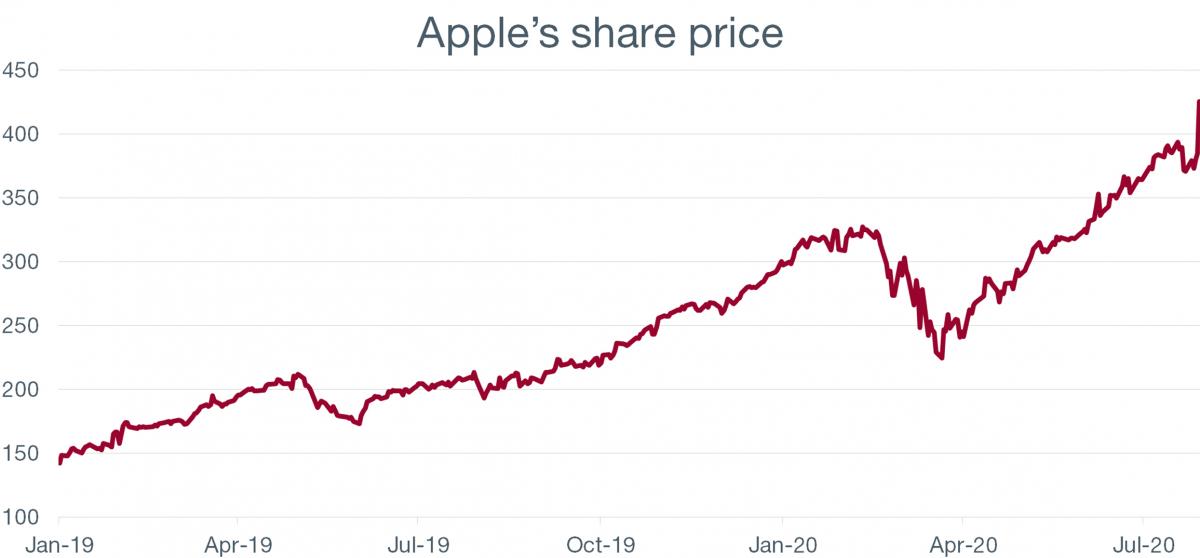

APPLE (ISIN: US0378331005, price: USD 425)

Apple’s third-quarter results defied the coronavirus crisis, with the group taking full advantage of the lockdown period despite the temporary store closures. Revenues rose to USD 59.69bn, up 10.9% versus the same fiscal quarter last year. Earnings clocked in at USD 2.58 per share versus expectations for USD 2.07.

Fears of a decline in sales were dispelled, with all business segments exhibiting brisk growth. Hardware accounted for the lion’s share of the revenue growth, although services also made solid inroads while also earning comfortable margins.

Sales of Macs (+31% vs. the prior-year period) and iPads (+22%) surged on the back of home-based working and e-learning. iPhone sales totalled USD 26.42bn, shooting past the consensus estimate of USD 22bn. Impressively strong demand for the low-end SE model demonstrates Apple’s ability to retain the confidence of its established customer base. In the midst of a recession, buyers were still willing to pay close to USD 400 for a smartphone – a testament to Apple’s brand power.

The release of next-generation iPhones, disrupted by supply and logistics glitches, has been delayed by a few weeks to mid-October. These devices, which will be 5G-compatible, are likely to encounter strong demand.

The surprise announcement of a four-for-one stock split similarly cheered investors. Historically, stock splits – which have become rare in recent years– have had a positive effect on performance because the securities in question then become more accessible to retail investors.

Flash boursier

Flash boursier