30/01/2023

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.00 | 11'332.30 | 4'178.01 | 15'150.03 | 7'097.21 | 7'765.15 | 4'070.56 | 11'621.71 | 27'382.56 | 1'051.19 |

| Trend | |||||||||||

| YTD | -0.37% | 1.13% | 5.62% | 10.13% | 8.81% | 9.63% | 4.21% | 6.02% | 11.04% | 4.94% | 9.91% |

(values from the Friday preceding publication)

Equity markets still rising

Equity markets continued to rally last week as investors were reassured by slowing inflation and resilient economic activity in the face of monetary tightening.

Bond yields were stable. The US 10-year yield hovered around 3.50% and the German equivalent just over 2.20%.

In the US, GDP grew at an annualised rate of 2.9% in the fourth quarter, compared with a forecast of 2.6%. Moreover, the contraction in the US private sector slowed in January, as indicated by a composite PMI of 46.6 – up from 45.0 in December.

The US economy remains resilient. Durable goods orders rose 5.6% in December, better than the 2.5% expected and welcome news after the 1.7% decline in November. Consumer spending, which accounts for more than two-thirds of US economic activity, edged down by 0.2% in December.

The US labour market remains in good shape. Initial jobless claims fell to 186,000 last week from 192,000 the previous week, compared with a forecast of 205,000. The number of people receiving regular benefits rose to 1.675 million in the week ending 14 January, up from 1.655 million the previous week.

Inflation has continued to ease, with personal consumption expenditures (PCE) rising 5% year-on-year in December, down from 5.5% in November. The core PCE index (which excludes energy and food) rose 4.4% year-on-year, slowing from 4.7% in the previous month. This could prompt the Fed to slow the pace of interest rate hikes as early as this week.

In Europe, economic conditions are improving. The Eurozone composite PMI rebounded for the third consecutive month in January, rising to 50.2 from 49.3 in December. The services index advanced to 50.7, while manufacturing output ebbed slightly. The impact of the energy crisis is clearly fading.

Against this backdrop, the S&P 500 ended the week up 2.47%, while the tech-heavy Nasdaq recovered by 4.32%. The Stoxx 600 Europe index was up 0.67%.

Highlights this week will be the Fed’s monetary policy announcement and the next batch of corporate earnings reports.

The increasing importance of non-financial information

The last decade was characterised by highly expansionary monetary policies. Benchmark rates were close to zero or even in negative territory. Yields on risk-free assets dried up, leading investors to take on more risk.

As interest rates on debt return to normal, some of the funds invested in risky sectors or investment vehicles are likely to be reallocated to more stable solutions.

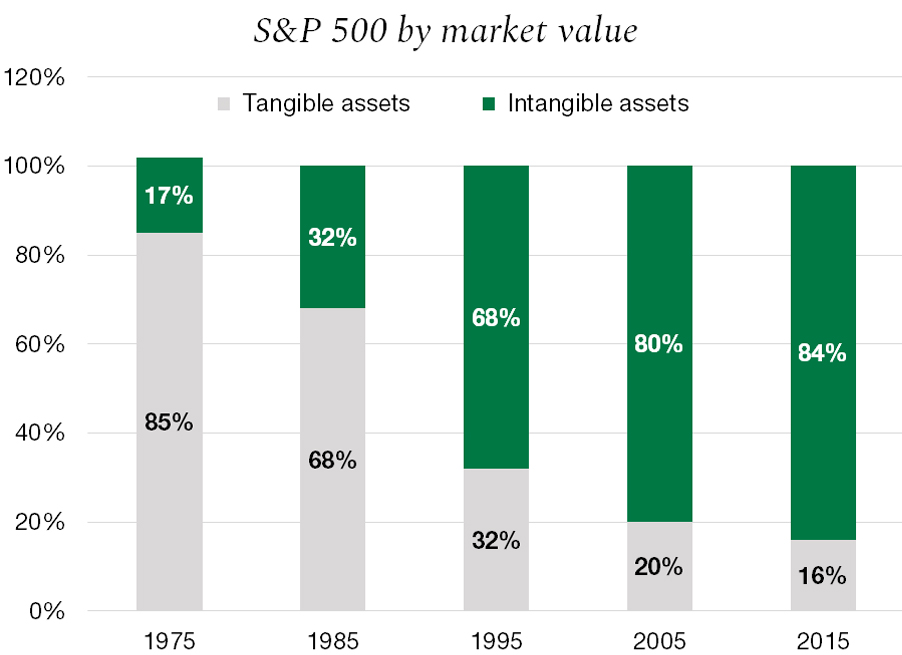

This is good news for sustainable investing because these strategies use a more comprehensive screening process than conventional solutions, giving investors a more accurate picture of a company’s true worth.

In addition, the current inflationary landscape and geopolitical conditions provide an incentive to overweight energy efficiency and energy transition assets.

Flash boursier

Flash boursier