Analyse July 2022

Inflation – central banks’ focal point

Video produced in collaboration with Le Temps

For around a decade, Western countries had forgotten what inflation looked like. Rate-setters worked overtime to try to stir it to life again and help it revert ideally to 2% on a 12-month basis. Then along came the pandemic and the war in Ukraine...

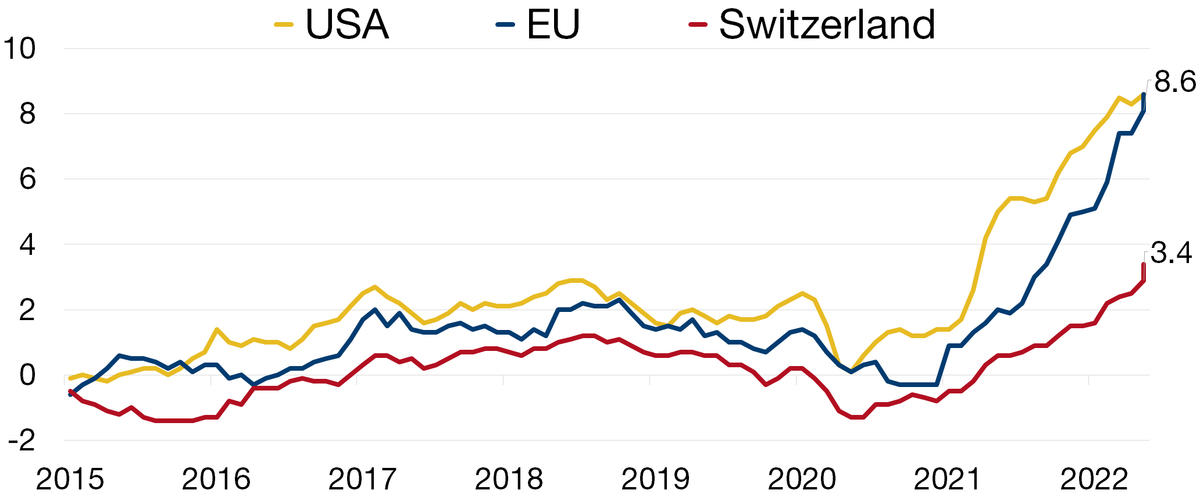

US consumer prices rose by 8.3% in April and by 8.6% in May year on year. This kind of inflation had not been witnessed since 1980. Matters are hardly better in Europe, where inflation quickened to 8.1% in May.

Inflation had already started picking up as economies were emerging from the pandemic, because companies could not cope with the sudden demand recovery. Another issue was disrupted trade routes, leading to further shortages that in turn nudged prices higher. The war in Ukraine then came along and poured oil on the fire – triggering massive upswings in the prices of crude oil, gas and agricultural commodities. Meanwhile, a handful of Chinese cities were locked down under Xi Jinping’s zero-covid policy, which further crippled supply chains.

Globally, inflation is expected at 6% this year, which is far higher than the 4% expected back in January. But that was before war broke out.

As a consequence, consumers’ purchasing power has been constrained, while global growth forecasts have been revised down. GDP growth on a global scale is expected a whisker above 2% this year versus a forecast over 4% back in January.

The Swiss exception

Against this bleak backdrop, Switzerland stands out once again as the exception. Inflation clocked in at 2.9% in May, driven up by higher prices of heating and vehicle fuel prices. If inflation is firmly below the rates seen in the rest of the world, it is because the country has the Swiss franc on its side.

The richly valued franc is making life difficult for Swiss exporters because it drives up the actual price of their goods for foreign customers. But the franc also confers the overwhelming advantage of lowering the cost of imported goods, thereby shielding the domestic economy from so-called imported inflation. Moreover, growth is unlikely to falter too much this year and is instead expected to stay close to 2.5%, marking only a moderate slowdown relative to 2021.

Grappling with inflation and its effects on purchasing power

Raising interest rates is a well-known formula for getting inflation under control, which is what the Fed is seeking to do. On 15 June, it hoisted borrowing rates to a sharp degree. The UK is doing likewise and the ECB recently joined the fray.

Problematically, higher borrowing costs also act as a brake on growth, which as we all know is not in great shape around the world. Central banks are therefore walking a tightrope, trying to get inflation back under control but without triggering a recession. The pundits call this a soft landing for the economy.

The Swiss National Bank also decided to act, hoisting its benchmark policy rate from -0.75% to -0.25% on 16 June. But the SNB has another factor to consider: raising the interest rate means boosting the value of the Swiss franc, which in turn dampens short-term economic conditions because it works against exporters.

For now, several countries have tried to cushion the impact of inflation through welfare programmes, just as they did during the pandemic.

Fig. 1. Inflation in the US, EU and Switzerland since 2015

Latest news from the Bonhôte Group

20 years in the heart of Biel/Bienne

To mark 20 years in the heart of Biel/Bienne, Bonhôte is expanding its office space and hiring three new managers plus one assistant, making this the largest wealth management team in the Biel/Bienne Seeland region.

General Manager of Bonhôte Biel/Bienne for the past ten years, Philippe Borner (centre-left) hands over the keys of the branch to Rico Tanner (centre-right), former General Manager of UBS Biel/Bienne-Seeland.

100th anniversary of Neuchâtel as a financial centre

Neuchâtel’s financial services industry this year celebrates its 100th anniversary. To mark this occasion, the city is running a communication campaign aimed at tomorrow’s generation. Bonhôte contributed by managing the entire project from start to finish.

Private viewing at the Hermitage

Bonhôte has been a partner of the Hermitage Foundation for the past five years. In June, we held a private viewing evening – as we do every year – ahead of the inauguration of the exhibition devoted to Achille Laugé.

Analyse

Analyse