Analyse January 2023

Potential change of course in mid-2023

Video produced in collaboration with Le Temps

The shackles were removed from the global economy once the pandemic abated, sparking a brisk recovery in demand for goods and services that has sent inflation soaring.

The prolonged period of inactivity has disrupted several economic sectors, causing serious logistical glitches and bottlenecks – particularly in China, where restrictions have been left in place for longer. Making matters worse, the sudden military conflict between Ukraine and Russia has triggered an energy crisis across Europe as gas and oil prices have surged.

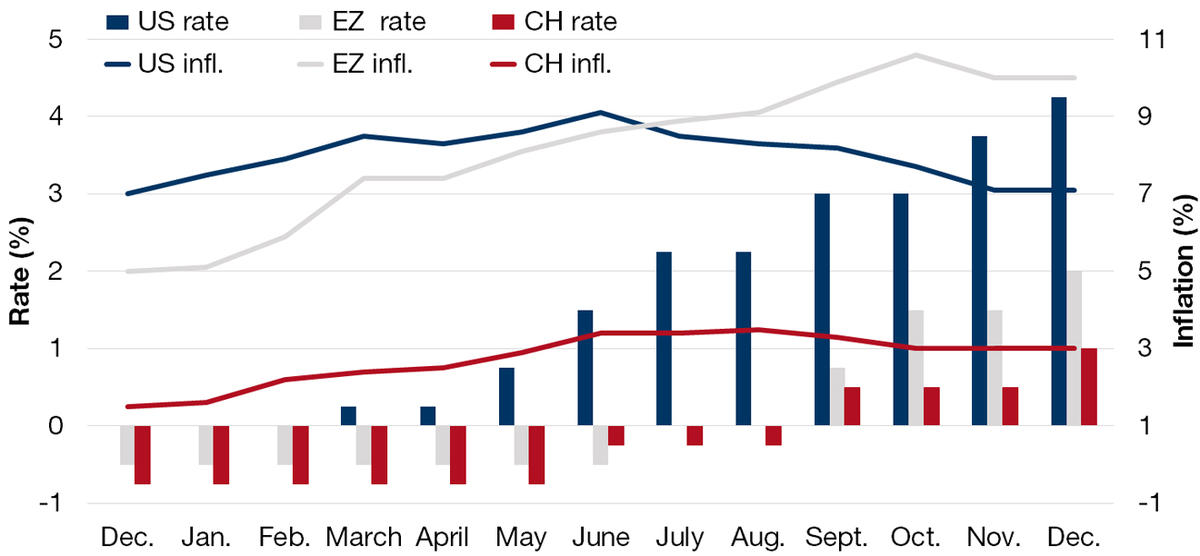

To curb the runaway inflation, central banks have switched to restrictive monetary policies by steadily raising interest rates, thus applying the brakes to global economic growth. According to central banks’ risk philosophy, excessive tightening is always less perilous than letting inflation run out of control. Short-term rates are now higher than their long-term counterpart, signalling a heightened risk of recession within Europe and the US in the quarters ahead.

The effects of restrictive monetary policies are taking time to materialise in the real economy. In the US, the job market is robust. At 3.7%, the unemployment rate is the lowest in 50 years, and recent wage increases continue to fuel consumer spending. Employees still have strong bargaining power, considering that there are two vacancies for every job seeker. But now companies are starting to announce job cuts in the face of the looming economic downturn.

In the Eurozone, where inflation was 10% in November, governments are likely to continue shielding households and companies from energy price rises through fiscal help and price caps. Such measures are necessary to maintain social cohesion, but this is preventing inflation from ebbing to target levels and forcing central banks to tighten more than they would otherwise.

The context is quite different in Switzerland, where inflation has not risen above 3%. This is thanks to the strength of the Swiss franc, which is keeping a lid on imported inflation. The problem is that the tight labour market – with unemployment at only 2% – is putting pressure on wages, which is forcing the SNB to raise its benchmark rate. We expect the Swiss rate to peak at 1.75-2.0% in mid-2023.

Economic outlook

Energy and food prices should eventually stabilise or even subside in the next 12 months, helping to bring inflation back into line with central banks’ targets by the end of 2024 or early 2025.

Central banks remain undaunted, for now. The continued tightening in policy over the coming months is likely to produce a peak around mid-2023. Terminal rates are expected somewhere upwards of 5% and 3% in the US and Europe, respectively. A soft landing for the global economy is still a possibility, but this would require a sharper decline in inflation than is currently anticipated.

Global economic growth is therefore expected around a paltry 2% in 2023, which will have a negative impact on companies’ profit forecasts.

Those companies so far benefiting from high household savings and low borrowing costs have been able to shield their margins.

The onset of recession – if this does occur next year – would probably signal the start of a price decline, leading to changes in monetary policy. We expect the Fed to pivot in the second half of next year, once inflation has started falling below 4%.

A rally could be sparked in both equity and bond markets once investors think they have identified that specific turning point.

Fixed-income investments such as government bonds or investment-grade corporate bonds have once again become attractive, exhibiting yields we would not have even dreamed of a year ago.

Benchmark and inflation rates

Latest news from the Bonhôte Group

Up close and personal with Alan Roura

The first two episodes in our series of videos on Alan Roura are now online, in which you can discover our ambassador from a new angle as he tells us about the values he shares with our institution.

After a first episode devoted to his background and sporting heritage, the second episode focuses on his Swiss-sponsored, people-centric project.

André Del Piero

Our new Chief Client Officer (CCO) is André Del Piero, who holds an MBA in Corporate Finance and has 30 years’ experience working for prestigious institutions.

He takes over from Robin Richard, who will continue serving his clients before taking early retirement in 2025.

UniNE Foundation: Bonhôte doubles set-up capital

The University of Neuchâtel is now endowed with a foundation established to raise funds via donations and legacies.

After being formed with set-up capital of CHF 50,000, the University of Neuchâtel foundation has received its first donation from Banque Bonhôte & Cie SA, which has matched the initial funding amount.

Analyse

Analyse