Analyse January 2021

Today’s losers may be tomorrow’s winners

Video production: Le Temps

Many countries around the globe are busy rolling out their vaccination campaigns. These eagerly awaited jabs are likely to foster the conditions for the global economy to get back on its feet again. Hence many investors are now wondering which stocks will be first in line to gain just as households and businesses return to some semblance of normalitys.

Nobody wants to dwell on 2020, such was the damage to people’s lives and livelihoods. What’s more, the full extent of the economic damage is not known. Governments have dished out massive amounts of fiscal stimulus, doing what they can to offset the impact. The story has been entirely different for equity markets, which seem to have already had their jab against the virus. Take, for instance, the MSCI World Index, which gained by 7% in Swiss franc terms.

US stocks leading the way

If we focus solely on indices, it’s hard to believe that the world has suffered its worst health emergency since the Spanish flu outbreak of 1918. A closer look however shows that divergences between sectors have actually been widening. Investors betting on large caps have come out on top. Stock prices in the US tech industry have been reminiscent of the year 2000. Majors such as Alphabet, Apple, Facebook and Amazon have surged ahead.

In Europe, by contrast, equity indices have not had it so good. The EuroStoxx 50 ended 2020 down 2.6%. The DAX, comprising German blue chips, was the only one to chalk up gains – alongside our very own SMI. The CAC 40 gave back 4%, while the FTSE 100 fell by 10%, dragged down by the protracted Brexit trade talks (concerning which a deal was achieved only shortly before Christmas).

Hope for those who missed out

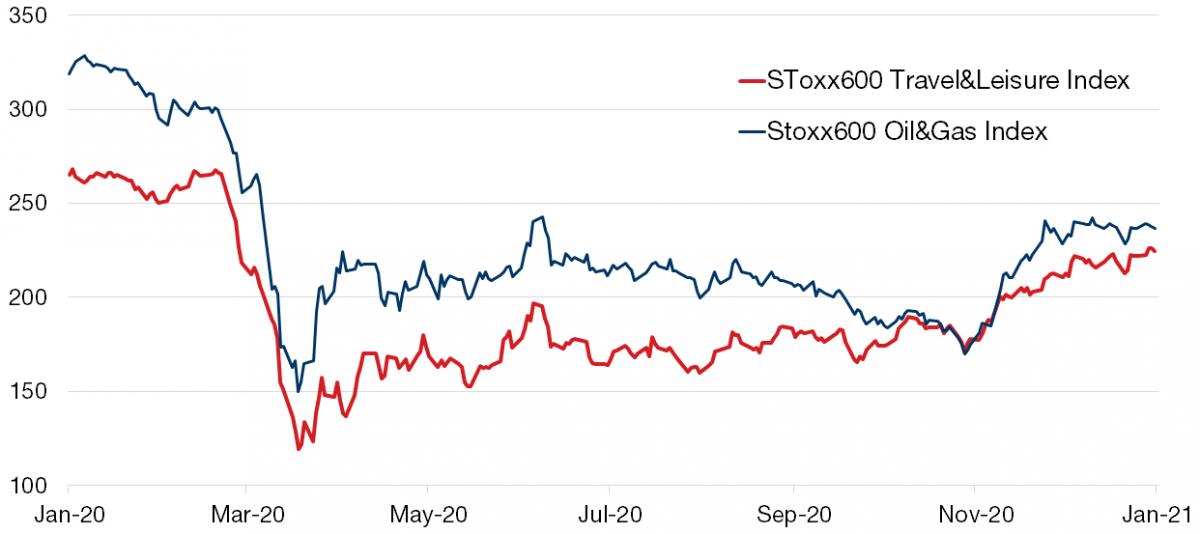

The extraordinary year that was 2020 produced a fair few losers; but these might also be tomorrow’s winners. The sector hit hardest – primarily because of the travel restrictions required to stem the pandemic – has been travel & leisure – encompassing both holiday and business travel. EasyJet, Lufthansa, TUI and US cruise giant Carnival have been hit particularly hard, with some such stocks falling by 40% or more. Switzerland has also had its victims, such as Dufry, which operates duty-free stores, and Zurich airport. If and when the economy picks up again, these companies are set to produce the best returns in 2021, according to brokers.

The energy sector has been hit by the contraction in global oil demand but is set to recover as people start travelling again and factories resume their usual schedules. But it can also be said that Covid-19 has simply accelerated the long-term trend towards other types of energy. Indeed, as societies switch to cleaner forms, it is by no means a given that the fossil fuel A-class, which includes Royal Dutch and Exxon Mobil, will ever revert to its pre-crisis glory. Investing is now greener, less carbon intensive and increasingly focused on renewable sources of energy. Expect more and more initiatives and regulations to promote the use of electric vehicles, for example.

Conditions for a recovery

Vaccination campaigns are starting to gain traction around the globe, whilst the fiscal splurges – comprising a large dose of infrastructure expenditure – are keeping economic growth ticking over. On this basis, a remedial rally among cyclical groups seems warranted. By this we mean those designing or selling the goods and services most in demand when economies are doing well (think manufacturing, carmakers and travel & leisure). Estimates for sales and earnings growth are more upbeat for 2021. We also anticipate that trade tensions will ease between the US and its main trading partners under the guidance of the Biden administration. Meanwhile, financials could also gain from a marginal increase in bond yields.

Nevertheless, with global GDP growth slack and inflation low, investors should not abandon the technology sector – a key feature of which is steady growth amid the trend towards increased digitalisation.

Fig. 1. MSCI World Index in 2020

Fig. 2. Travel & leisure and oil & gas in 2020

Latest news from the Bonhôte Group

Bonhôte-Immobilier - capital raising and SICAV status

Last year was a busy time for our property fund, which switched its legal status to an open-ended investment company (Swiss SICAV) and raised fresh capital to the tune of almost CHF 78 million. This inflow of capital enabled the fund, whose property portfolio is now worth more than CHF 1 billion, to buy a pool of four business hotels in the canton of Neuchâtel and a complex of four residential buildings in Vully-les-Lacs, in Vaud canton.

Bonhôte Foundation for Contemporary Art

The Bonhôte Foundation for Contemporary Art provided much-needed help ahead of the festive season last year, handing over cheques to ten cultural pioneers and associations in the region. All in all, CHF 20,000 was provided by the Bank’s charitable arm to support the arts through this difficult time.

Next generation of sportspeople

We’re delighted to welcome three young athletes into our next-generation programme.

Julie and Nicolas Franconville (badminton) and Loanne Duvoisin (triathlon) are now sponsored by our institution.

For more information, visit bonhote.ch/next-sporting-generation.

Analyse

Analyse