02/09/2019

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.99 | 1.09 | 9'895.65 | 3'426.76 | 11'939.28 | 5'480.48 | 7'207.18 | 2'926.46 | 7'962.88 | 20'704.37 | 984.33 |

| Trend | |||||||||||

| %YTD | 0.90% | -3.43% | 17.40% | 14.17% | 13.07% | 15.85% | 7.12% | 16.74% | 20.01% | 3.45% | 1.92% |

Highlights:

1. Trade dispute worsens

2. Steady slide in government bond yields

September is here

Higher customs duties, whacking USD 125bn of Chinese imports with a 15% tax, became effective yesterday in the US. According to China, this measure marks a turning point in the trade tussle and, in response, it will levy new customs duties on USD 75bn of imports from the US, ranging between 5% and 10% depending on the type of goods. Even so, phone contact is ongoing between Washington and Beijing, if Donald Trump is to be believed.

Over in bond markets, yields on government paper continue to head south. Net inflows into this asset class reflect fears of a global economic slowdown and a weaker earnings outlook for companies. Estimates point to EPS growth of a mere 2% for companies making up the MSCI World Index. The flattening yield curve is in turn stoking concerns over a possible recession while any inversion, however minor, between two- and ten-year maturities is jumped on by investors as a pretext for pocketing gains on equities.

The yield on the ten-year Italian government bond (BTP) last week retraced below the 1% mark after Giuseppe Conte was reappointed prime minister, leading a new coalition government between the Five Star Party and the Social Democrats. With early elections averted, investors have been reassured as the spectre of a right-wing administration is fading.

In the US, manufacturing output recovered in August based on an upswing by the ISM indicator. In the latest estimate of second-quarter GDP, consumer spending – growth in which was revised up to 4.7% year on year – represented one of the best scores in the current expansionary cycle, showing that the US economy remains resilient. In China, manufacturing output seems to have regained strength in August based on a Caixin PMI indicator at 50.4. By contrast, exports are sagging. To offset the slowdown, the yuan is continuing to appreciate. The latest pivot rate is 7.16 against the US dollar. We foresee a yuan-dollar rate not far from 7.30 towards the end of the year.

Progress in trade talks is set to be the guiding force in equity markets over the coming months.

Novartis AG (ISIN: CH0012005267, price: CHF 89.01)

The Basel-based pharma concern on Friday announced a clinical breakthrough in connection with an experimental treatment for multiple sclerosis, Ofatumumab. The compound has demonstrated a significant reduction in the rate of relapses in patients and a slower progression of disabling symptoms.

This news sent the share higher during intra-day trading on Friday but the best news is the potential impact on the disease. The compound looks far more effective than the treatments marketed by the group’s two main rivals, Sanofi and Roche. Those wanting an clearer idea of Ofatumumab’s competitive edge will need to wait until 13 September, when Novartis will provide more details at the next annual meeting of the European Committee for Treatment and Research in Multiple Sclerosis (ECTRIMS).

This latest development is the fruit of Novartis’ efforts to refocus business on highly specific biological solutions, including acquisitions where necessary. The group is facing a ‘patent cliff’, leading to a sharp drop in sales as generics treating indications no longer covered by patents hit the market.

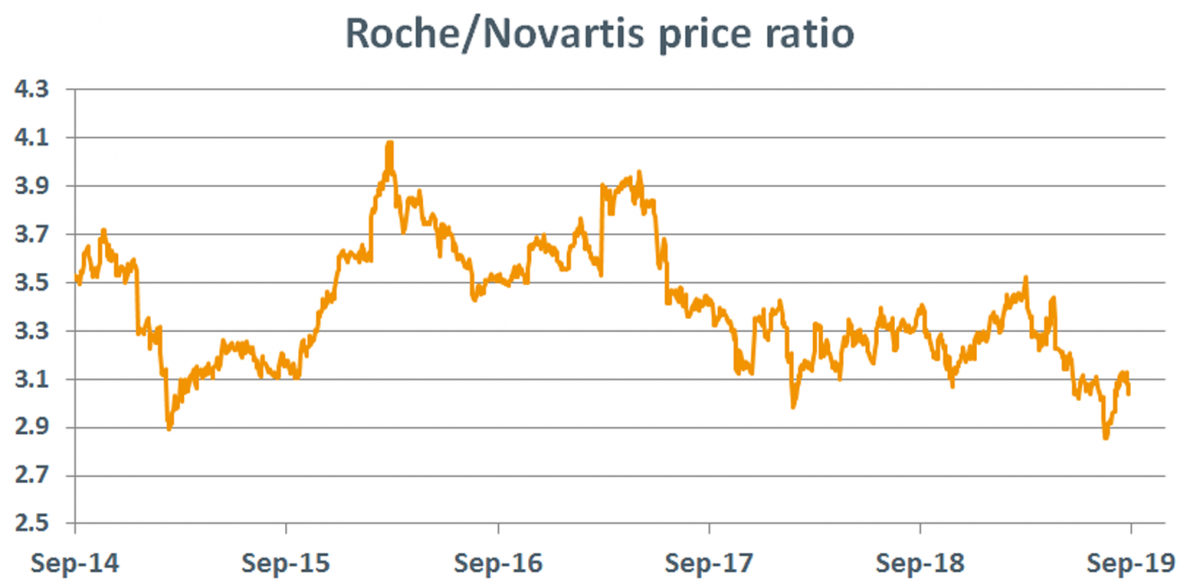

The group’s new strategy has triggered a wave of earnings upgrades over recent months. After making gains, the share today looks fully valued. Based on the price ratio between the two majors Roche and Novartis over the past five years (see the chart here above), our preference now lies with Roche.

Download the Flash boursier (pdf)

Flash boursier

Flash boursier