17/02/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.98 | 1.06 | 11'128.81 | 3'840.97 | 13'744.21 | 6'069.35 | 7'409.13 | 3'380.16 | 9'731.18 | 23'687.59 | 1'106.30 |

| Trend | |||||||||||

| %YTD | 1.62% | -1.95% | 4.82% | 2.56% | 3.74% | 1.53% | -1.77% | 4.62% | 8.45% | 0.13% | -0.75% |

Highlights:

1. Investors unconcerned by coronavirus

2. Fears of recession dispelled in the US

PBoC funnels more liquidity into the financial system

Output from the Chinese economy was only 40-50% of its usual capacity last week. The threat hanging over the world economy is that the coronavirus will prevent companies from functioning normally, thereby disrupting supply chains and leading to a shortage of components. No doubt, the coronavirus will pin back economic growth in China, which could grind to a standstill in the first quarter of 2020 – with potential knock-on effects for the global economy, considering that China accounts for 18% of global GDP. However, all these effects are being labelled as ‘temporary’ by most.

The German economy is in a worrying state, even before the coronavirus. GDP went almost nowhere in the final quarter of 2019, edging up by a meagre 0.4% year on year. The euro continues to languish in forex markets, trading at its lowest level since April 2017. US retail sales rose by 0.3% in January versus the previous month and 4.4% on an annual basis, in line with estimates. In Japan, figures showed GDP decreasing by 1.6% in the fourth quarter of 2019. The hike in the sales tax on 1 October dampened consumer spending, which plunged by 2.9% in the period under review. Business investment similarly fell sharply.

The impact of the coronavirus will probably be felt in terms of corporate earnings in the first quarter. Some groups have already said as much. Currently, analysts are trimming their earnings estimates; all the while, equity markets are flirting with new all-time highs. Such a carefree attitude among investors seems strange at a time when multiples are on the rise. In fact, investors are pricing in a recovery following the temporary hit to growth. Rising share prices also signal that they expect central banks to chuck some more easy money at the situation. The People’s Bank of China recently injected some more liquidity in the form of medium-term loans to banks while cutting the repo rate in an attempt to boost lending.

Speaking before a congressional committee last week, Jerome Powel sounded a reassuring note, expressing a viewpoint that the US was on a firm foundation and a recession was unlikely. Job creation over the last three months has been positive for consumer confidence and spending. We therefore think that the coronavirus would have to make a lasting impact for the Fed to change monetary policy and resume rate-cutting. Yet this eventuality remains an option in the minds of investors, contributing to higher equity-index levels.

In bonds, the quest for yield continues apace with the Greek 10-year sovereign now returning 0.9%, at the same level as Italian BTPs.

Swatch bearer share (ISIN: CH0012255151, price: CHF 253)

By past standards, Swatch is trading on an attractive 16x estimated 2020 earnings, but all is not as rosy as it seems.

First of all, the luxury segment – to which Swatch belongs – has many constituents whose business is far more upscale than Swatch’s. Take Richemont and Hermès, for example. Being a less luxurious group means lower margins, compared with peers. And a less prestigious market position exposes it more heavily to economic conditions. HNWIs are obviously less responsive to changes in the business climate.

Additionally, over 60% of sales stem from Asia, compared with 45% at Richemont, making the group more vulnerable to events there (coronavirus and demonstrations in Hong Kong). Swatch is less inclined to adapt costs to fluctuations in the business cycle. It tends not to fire people to safeguard margins, as this is not part of its business culture.

Swatch is nonetheless a rock-solid firm that has zero debt and cash reserves equivalent to 11% of its market capitalisation. Although 2019 figures were down relative to 2018, the dividend yield of 3% has been reaffirmed.

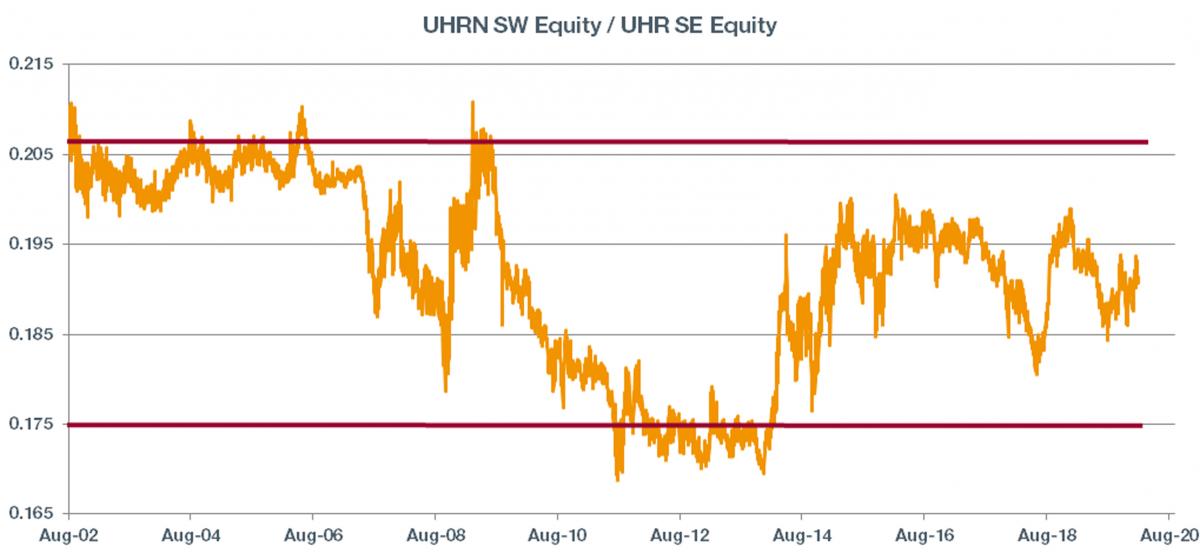

At current levels, the ratio between the Swatch registered share and the Swatch bearer share is relatively neutral by past standards, at midpoint in the channel. In the short term the share is likely to ebb and flow with events in Asia.

Flash boursier

Flash boursier