04/05/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.97 | 1.06 | 9'629.40 | 2'927.93 | 10'861.64 | 4'572.18 | 5'901.21 | 2'912.43 | 8'889.55 | 20'193.69 | 924.94 |

| Trend | |||||||||||

| %YTD | -0.24% | -2.57% | -9.30% | -21.82% | -18.02% | -23.52% | -21.76% | -9.85% | -0.93% | -14.64% | -17.02% |

Highlights:

1. Abrupt fall on Wall Street

2. Sharp decline in US stats expected

US-China trade tensions make a comeback

For equity investors, the most striking event last week was the sudden plunge on Wall Street, which slid by almost 3% on 1 May after the market gave the thumbs down to current-quarter guidance from tech majors of the likes of Apple and Amazon. In any case, indices in April had pulled back considerably from their March lows, with the S&P 400 rising by 12.7% – clawing back half its losses – and the Stoxx 500 and the SPI gaining by 6.7% and 5.2% respectively. Most of this relief rally was powered by fiscal and monetary splurges, coupled with the prospect that new Covid-19 cases may have peaked. Investors are probably now questioning whether the market recovery has the stamina to continue. Fears about the global economy are mounting. A surge in new virus cases following the easing of lockdown measures could send the global economy into a tailspin.

Washington and Beijing are at loggerheads again, as part of a blame game for who is behind the coronavirus. According to Mike Pompeo, Secretary of State, on ABC TV, the coronavirus originated from a laboratory in Wuhan, with the purported aim of stealing a march on the rest of the world. The US is considering retaliatory trade measures, including a raft of new duties, while issuing a reminder that under ‘phase 1’ of last year’s agreement, the Chinese are duty bound to buy US goods. If you thought the tensions in financial markets caused by the trade war were bad last year, worse may still be to come.

Doubts are becoming prevalent pending the effects of ‘phase 2’ on the economic situation, as illustrated by the steady collapse in crude oil prices. Economic stats are in a dire state. US consumer spending nosedived by 7.6% in the first quarter and manufacturing indicators fell sharply. With a Covid-19 vaccine probably more than a year away, it is unclear whether the economy can get back on its feet again. All will depend on how the relaxation of lockdown measures unfolds.

On the earnings side, 55% of S&P 500 companies have reported first-quarter numbers. On average these have been 2.5% below expectations. The 16% drop in earnings versus the same period last year is staggering but the overall figure was dragged down by specific sectors such as airlines and oil companies. For the second quarter, a 13% contraction in earnings is expected by the consensus. On Friday, US employment figures for April will be released. Expectations are for 22 million job losses, with the unemployment rate rising to an unprecedented 16%.

Microsoft (ISIN: US5949181045, price: USD 174.70)

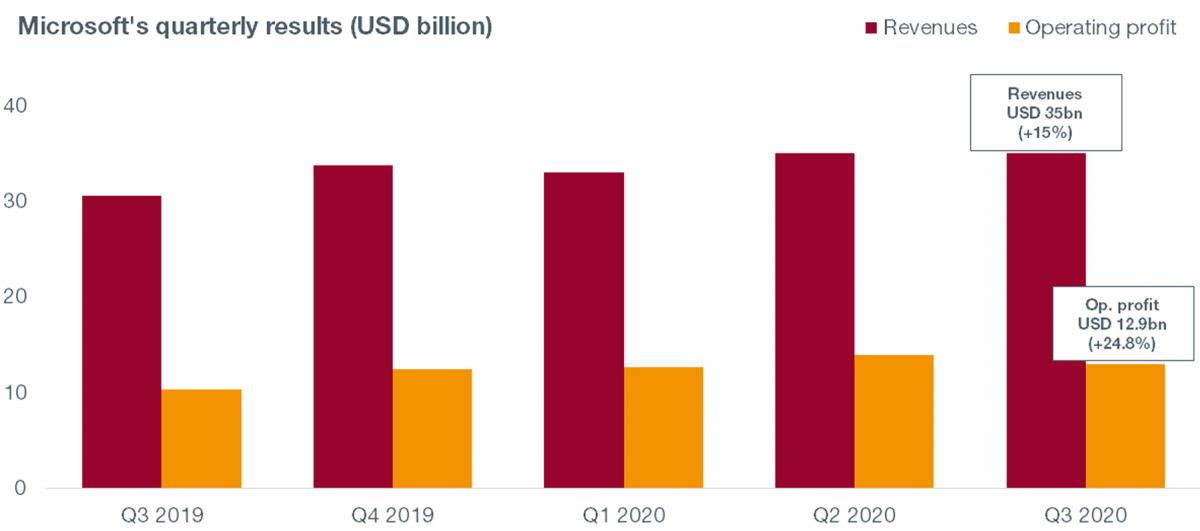

Microsoft reported a 15% increase in revenues to USD 35 billion for its third fiscal quarter ending in March. Operating income rose 25% to USD 13 billion and net earnings per share was USD 1.40.

Amid the Covid-19 lockdown, the group underwent two years of digital transformation in the space of just two months. Some activities took a hit, notably linked to the slowdown in advertising on LinkedIn and the Bing search engine. But the Intelligent Cloud segment, which includes Azure, performed extremely well. Revenues shot up by 27%, from USD 9.65 billion to USD 12.28 bn. Azure’s revenues alone surged by 59%.

Current-quarter guidance is on the low side, with revenue expected in the range between USD 35.85 and 36.80 billion. Microsoft anticipates a slower demand from SMEs for licenses. Advertising spending on LinkedIn is not expected to improve, the consequence of a weak job market. Expenditure is set to increase through investments in cloud and engineering.

Yet Microsoft has a recurring revenue model and a wide range of products popular with customers during the pandemic. Productivity tools (Office 365), hybrid cloud infrastructure solutions (Server and Azure) and the portfolio of products for work/gaming at home (Windows, Surface and Xbox Live) are all expected to gain market share. And corporations are due to accelerate their migration to the cloud – a trend that should sustain growth for years to come.

Flash boursier

Flash boursier