14/12/2020

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.89 | 1.08 | 10'391.76 | 3'485.84 | 13'114.30 | 5'507.55 | 5'935.98 | 3'663.46 | 12'377.87 | 26'652.52 | 1'257.66 |

| Trend | |||||||||||

| %YTD | -8.01% | -0.72% | -2.12% | -6.92% | -1.02% | -7.87% | -21.30% | 13.39% | 37.95% | 12.66% | 12.83% |

Highlights:

1. Market volatility on the rise

2. Central banks slash growth forecasts

Who remembers the PIGS?

Last week was a hazy time in equity markets, reflected by rising volatility. The VIX – the ‘fear gauge’ tracking the price of S&P 500-linked options – shot up to 23, having steadily receded since October.

Most stockmarket indices headed down towards the end of last week, led by Frankfurt, as virus cases surged and a flurry of new lockdown measures were announced. Anxiety was also the mood prevailing on Wall Street. The S&P500 headed lower as it became clearer that a fiscal deal is unlikely to see the day any time this year. Investors also ditched some of their equity positions pending FDA clearance of the Pfizer-Biontech vaccine. More clarity over the efficacy and safety of the Covid-19 vaccines is undoubtedly needed if the equity uptrend is to get back on track.

Leading central banks have furthermore revised down their GDP projections for 2021. The Bundesbank now sees growth at 3% for Germany, while the ECB has lowered its expansion forecast to 3.9% for the Eurozone, down from 5%. Meanwhile, the Bank of Italy has cut its national growth forecast from 4.8% to 3.5%.

In general, risk aversion – stoked by the Brexit haze – has pushed up demand for government bonds. In Europe, the yield on the 10-year Bund has dropped to -0.64%. Likewise, the same-dated BTP in Italy now yields 0.52%. The yield on the 10-year bond from Portugal, which in 2011 was rescued by a Troika plan (ECB, EC and IMF working together), has fallen below zero for the first time in its history, clocking in at -0.06%, signalling the genuine shortage of profitable debt investments. This is largely thanks to the ECB, which now holds more assets on its balance sheet than the Fed, with more in store. The downswing in European sovereign yields has been phenomenal, especially in the peripheral countries, once nicknamed the ‘PIGS’ (Portugal, Italy, Greece, Spain). The ECB is due to beef up its pandemic emergency purchase plan (PEPP) by EUR 500bn to a total of EUR 1,850bn. It is also extending its intervention period by nine months, from June 2021 to March 2022. Financing terms are set to remain favourable for a long time to come.

In the US, the Fed will issue a long-awaited update on monetary expansion policy this coming Wednesday.

IPO takes market by storm - Airbnb (ISIN: US0090661010, price: USD 139.25)

Airbnb, the private holiday-rental platform, stormed into the market last week via its huge IPO. The closing price on the first day of trading was USD 144.71. The issue price had earlier risen to USD 68.00 from the initial range of USD 44-50.00 the week prior. This was despite the fact that the business sector in which the US company operates – tourism – has been having an exceptionally tough time.

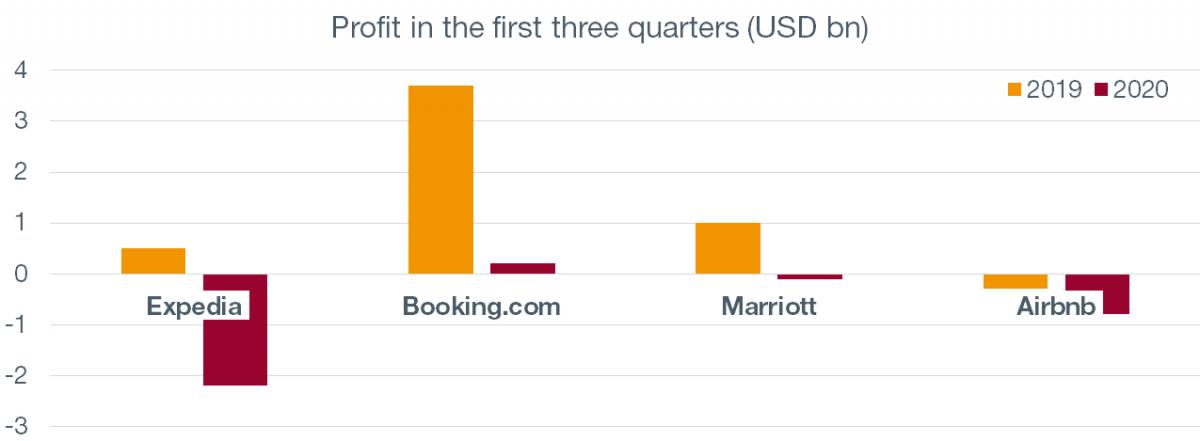

Investor appetite for IPOs illustrates the mood of optimism (bordering on euphoria) that is reigning in financial markets as we say goodbye to 2020, at a time when many economies find themselves on life support. The second wave of the epidemic is in full swing across much of the northern hemisphere, with some countries locking down again – and there is already talk of a third wave. This dichotomy is difficult to explain, as is the valuation of Airbnb. How can such a price be justified for a company that is not returning a profit (see chart) and which exists to encourage travelling, at a time when everyone is staying home?

Here’s why, we think. Airbnb is the Alibaba of the hotel sector, an online platform that connects people. The beauty of this business model is that it is ‘asset lite’, with low fixed assets on the balance sheet (compared with hotel groups). The company operates through a website and a smartphone application and takes a cut on each booking. Its business will get back on its feet more quickly than the hotel sector. Against the current backdrop, Airbnb offers the advantage of being ‘at home elsewhere’, in full respect of distancing measures – an attractive alternative to hotels and their bustling entry halls, lifts, bars and restaurants. Its ease of use, the ever-increasing number of properties on the platform, the ever-expanding geographical footprint and its highly competitive prices all place Airbnb in pole position to snatch more market share.

So, what’s your price?

Flash boursier

Flash boursier