Analyse June 2018

Has the food sector lost its defensive appeal?

Investors used to think that food companies were shielded from fluctuations – because people eat every day – and that their markets were reasonably robust, but their share prices have been marked down significantly. Has the sector lost its defensive appeal? Not really. It is facing numerous challenges, but it has ways of dealing with them.

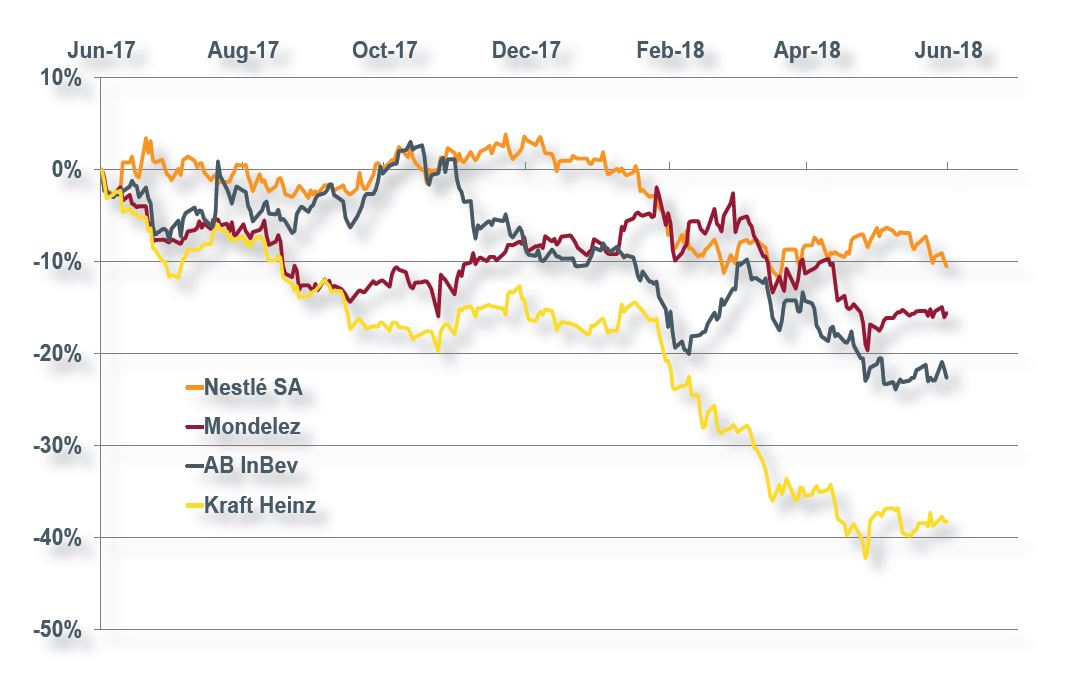

Shareholders are entitled to be confused. Some food companies have recently seen their share prices fall sharply from their highs, including Kraft-Heinz (-40%), Altria (formerly Philip Morris, -30%), AB-Inbev (which owns the Budweiser, Stella and Corona brands, -30%), Mondelez (the owner of Oreo and Cadbury, -20%), Nestlé (-12%) and Coca-Cola (-12%). The reason for this change of fortune, this sudden apparent vulnerability, relates to the major developments taking place in the food industry’s economic environment.

Many challenges

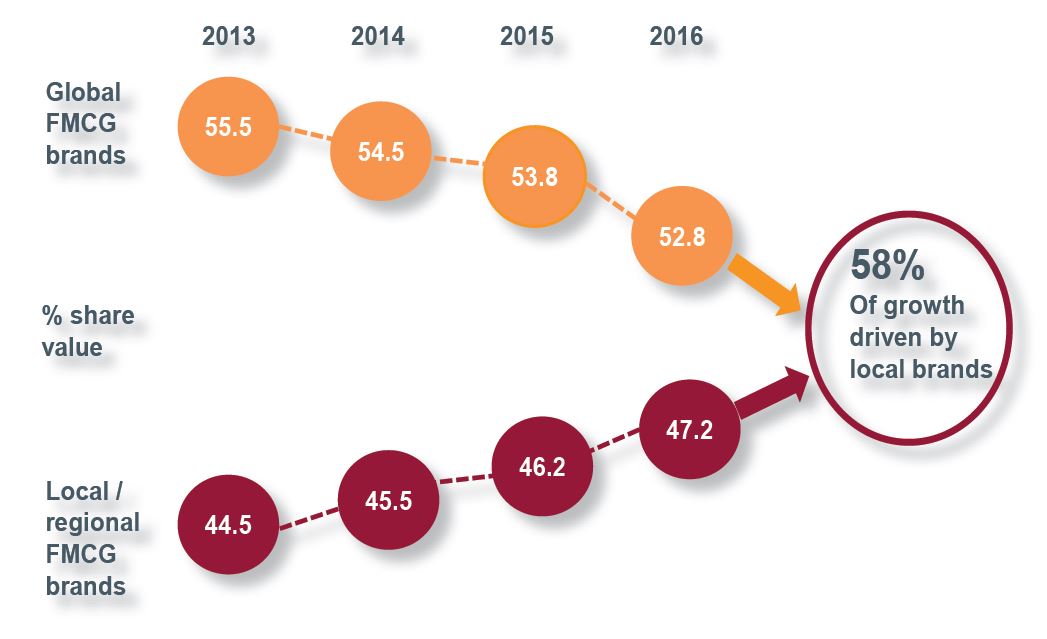

Firstly, consumers want healthier, more natural products, coming from closer to home and of a higher quality. One the one hand, customers want to pay the lowest price for staples, but are prepared to pay extra for products that are more in line with their aspirations. One example of how this is affecting the market is the way in which both “craft beer” and budget products are eating away at the sales of established beer brands.

The trial of strength currently taking place between Nestlé and supermarket retailer Coop in Switzerland illustrates the changes taking place in retail networks and the resulting shift in the balance of power. The increasing number of supply sources is giving more power to retailers, which are benefiting from price-focused consumer demand. At the same time, digitalisation and online sales are leading to tougher competition between retailers, and small players now have better access to the market.

The rising cost of raw materials, packaging and labour is also putting pressure on margins, because the pricing power is limited in the sector. In addition, the food market is mature, and it is growing at a slower rate than the economy in general. Nestlé is a good illustration: whereas its annual sales comfortably exceeded CHF100 billion between 2007 and 2009, they are currently around CHF90 billion. Even if we take into account the rise in the Swiss franc, growth has been very limited.

The sector is responding

However, the sector’s decline is not inevitable, because food producers are not sitting idly by. They have ways of dealing with these new challenges. They are adopting more personalised forms of communication – both digital and direct advertising – in order to form closer bonds with their customers. They are also using big data to adapt their products more effectively to particular regions or contexts. They are adjusting their product ranges to respond to consumer demand for healthier products – containing less sugar, salt, preservatives and colourings – and for high-end products (e.g. Nespresso). They are offering more vegetarian and vegan options, enriching products with vitamins and adding protein. They are also using innovation to increase productivity, improve quality, reduce production costs and therefore widen margins.

How does this affect investors?

These changes are clearly significant for investors. After their recent decline, sector valuations are now attractive again, although not irresistible. Many companies are paying large dividends and are managing their finances in a shareholder-friendly way. However, rising interest rates, particularly in the USA, is bad news because the sector’s steady dividend flows mean that stocks are sometimes valued in a similar way to bonds.

In the circumstances, we recommend the following stocks:

- Nestlé for its solidity, its share buyback programme and the speculative appeal of its stake in L’Oréal;

- Danone for its focus on products aimed at children, which could benefit from the relaxation of China’s one-child policy;

- Anheuser-Bush Inbev which will benefit from the upcoming football World Cup;

- Philip Morris International which is probably more advanced than any other company in its sector in terms of replacing cigarettes with less harmful products, although it does not meet normal social responsibility criteria.

Fig. 1. Stockmarket performances of four stocks in the last year.

Fig. 2. Local brands are challenging their global rivals.

Bonhôte Group news

New partnership with the Fondation de l’Hermitage

Bonhôte is partnering with Lausanne’s Fondation de l’Hermitage to host the “Manguin, la volupté de la couleur” exhibition, which will take place between 22 June and 28 October 2018. This new partnership strengthens our ties with the Bugnion family, which founded both the Musée de l’Hermitage and former Lausanne bank Bugnion & Cie, whose offices at 5, rue du Grand-Chêne Bonhôte now occupies.

New hires at Bonhôte-Immobilier

To keep pace with its growth, the Bonhôte-Immobilier real-estate investment fund has recruited two new talented members of staff. In early June, Philippe Salvi joined us from Cardis Sotheby’s. His duties include promoting the fund and taking care of investor relations. Christophe Courteux also arrived on 2 May, and is handling the fund’s technical management from our branch in Geneva.

“Industrie 4.0 - the Shapers” awards

To acknowledge innovation in the world of manufacturing, Bonhôte sponsored “The Shapers” awards, recognising those spearheading the fourth industrial revolution and leading the way in areas such as artificial intelligence, the internet of things and 3D printing. The ceremony took place on Tuesday 5 June at the Hotel Beaulac in Neuchâtel, and was attended by 200 leading figures in the fields of manufacturing and business. Photos of the event can be seen on the back cover of this publication, and more information can be found on our website at www.bonhote.ch/4-0.

Analyse

Analyse