Analyse October 2021

Stop-start upturn in tourism

Video production: Le Temps

Tourism industry leaders in Switzerland and elsewhere have been pleased to see that their customers have lost none of their appetite for travelling. But the pandemic is very much still with us. The related restrictions have curbed travel, and the uncertainty still lingers on. Travel operators have fared better than last year, but their performance has lagged well below 2019 levels.

In Switzerland this summer, the beginning of the school holiday period signalled that people still really wanted to travel, get away from it all and expand their horizons. All these aspirations had been curtailed by the pandemic. On Saturday 3 July, 150,000 people passed through Geneva and Zurich airports. Not all of them were able to take off on time, though, as a result of the chaos caused by the introduction of the covid certificate.

That initial rush raised the prospect of a welcome upturn – the travel industry certainly had a long way to bounce back from. In 2020, the number of international tourists arriving in Switzerland was 74% lower than in the previous year. The tourism industry at large lost $1.3bn.

Recovery from the spring onwards

Light began to appear at the end of the tunnel from the spring onwards. Destinations that had been closed for weeks gradually started to reopen. Tourist hotspots such as Italy, Spain, Greece, Portugal and Egypt did not want the summer to be a repeat of the previous year and so they pulled out all the stops. The numbers coming out so far during September look better than expected.

European airlines’ passenger numbers are running at 65-70% of the level recorded in 2019, the last normal year on record. The load factor for domestic flights in the US has been comparable. For the period from July to end-September, easyJet decided to increase its capacity to 60% of pre-pandemic levels, from no more than 17% previously. Spain, the world’s number-two tourist destination after France, attracted 4.4m tourists in July. That’s 78% more than in 2020, but still less than half the 9.9m who visited the country in 2019. Noticeable by their absence were British tourists and, of course, those travelling from further afield, such as the US and Asia.

The absence of longer-distance travellers, who really make a difference, was also felt in Switzerland. Not only do they account for one-fifth of hotel nights in normal times, but they are also the biggest spenders. Chinese tourists spend an average of CHF 380 per day, for example. The average for visitors from India, Indonesia and the US ranges between CHF 280 and CHF 310. And it’s CHF 210 for those from Great Britain. By contrast, the average spend for this summer’s tourists from France, Germany, Belgium and Switzerland itself was just CHF 140 per day.

Risks of another downturn

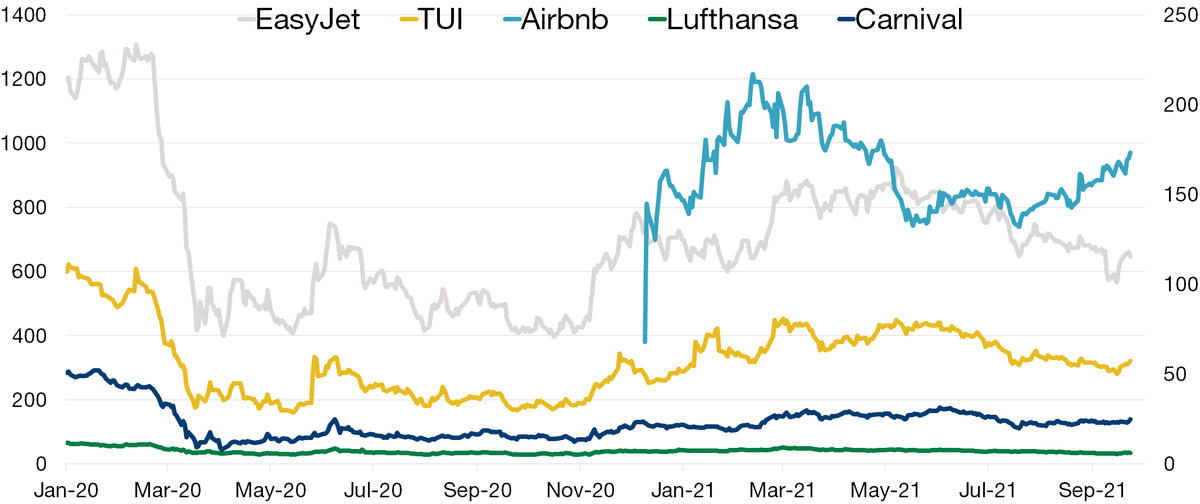

Even though the buds of recovery are springing up everywhere, it would be foolhardy to make highly optimistic predictions. In the short term, most destinations and airlines anticipate another downturn during the autumn. Investors’ expectations, as reflected by the financial markets, also factor in this stop-start pattern. TUI, the world’s largest travel operator, has struggled to regain any share price momentum since the beginning of the year after a slide of over 50% in 2020. Airbnb, the accommodation rental platform, has more or less been treading water since its successful IPO last December.

European airlines easyJet and Lufthansa, which owns Swiss, have yet to recover from the heavy losses sustained last year.

US cruise giant Carnival, which had seen its share price slump by close to 60% last year, has bounced back only modestly so far in 2021. In a broadly similar area, Airbus shares have, however, perked up. Amid strong demand, the European planemaker plans to step up the pace of its deliveries despite recording some 130 order cancellations between January and end-June.

To sum up, global tourism is faring better, but has not yet regained its pre-pandemic levels. And no one really knows when and even if it will be able to do so.

Fig. 1. Share prices of selected travel & leisure groups

Latest news from the Bonhôte Group

3 new acquisitions by Bonhôte-Immobilier SICAV and a zero-coupon bond

Bonhôte-Immobilier SICAV recently acquired three buildings representing almost 100 housing units in total, for an investment of CHF 35 million. They are located in Diegten (Basel Landschaft), Pont-en-Ogoz (Fribourg), and Martigny (Valais). The buildings are either new or recent.

For the first time, Bonhôte-Immobilier SICAV has issued a zero-coupon bond over six months for a total amount of CHF 20 million.

Advertising campaign in Geneva

Bonhôte Bank can now be widely seen in its new mobile advertising campaign in the city of Geneva. Through our slogan “tailor-made wealth management”, we are reaching out to private clients in search of a personalised service and sound advice for their investments.

For more information, see bonhote.ch/advertising.

Garden party

Our traditional garden party took place in late August. Following the pandemic-related restrictions, this event gave space for our clients to network with their portfolio managers and the Bank’s executives in an informal, relaxed setting.

For more information, see bonhote.ch/garden-party-21.

Analyse

Analyse